Read More, Comment and Share......

All Posts (788)

H/T Ryan

Read More, Comment and Share......

Wall Street’s reaction to hotter-than-estimated inflation data suggested growing bets the Federal Reserve has a long ways to go in its aggressive tightening crusade, making the odds of a soft landing look slimmer.

After a lengthy period of subdued equity swings, volatility has been gaining traction. That doesn’t bode well for a market that’s gotten more expensive after an exuberant rally from its October lows. Stock gains have been dwindling by the day amid fears that a recession in the world’s largest economy could further hamper the prospects for Corporate America.

A slide in the S&P 500 Friday added to its worst weekly selloff since early December. The tech-heavy Nasdaq 100 tumbled about 2% as the Treasury two-year yield topped 4.8%, the highest since 2007. The dollar climbed. Swaps are now pricing in 25 basis-point hikes at the Fed’s next three meetings, and bets on the peak rate rose to about 5.4% by July. The benchmark sits in a 4.5%-4.75% range.

“There’s little room for upside i

Read More, Comment and Share......

Read More, Comment and Share......

Read More, Comment and Share......

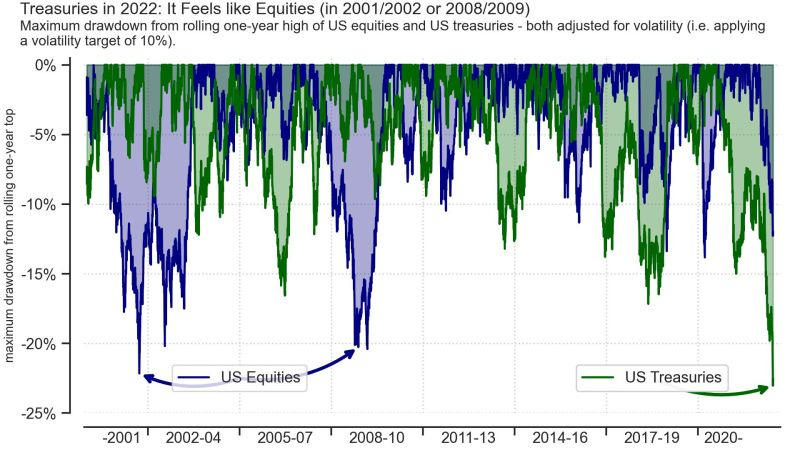

1. The Worst of Times: In hindsight, it was never going to end well when both stocks AND bonds were trading at crazy expensive levels. It is the worse case scenario for traditional passive buy and hold portfolios.

Source: Dr. Timo Teuber

2. Max Pain: Passive buy and hold + stocks and bonds down = portfolio pain. And it is showing up clearly in Google Trends data on searches for "why is 401k down".

Source: @Callum_Thomas Google Trends

3. Extreme Valuation Swinging: We’ve just witnessed an extremely rapid and substantial contraction in P/E multiples (which follows a previous extremely rapid and substantial expansion!). The question many will ask: "is it cheap yet?"

Source: @keyeventrisk

4. Is it Cheap Yet? In terms of levels, even though the US PE10 ratio has come down sharply, it is still some way off the bottoms seen in 2016/18/20. So I would say no, it is not cheap yet: not expensive anymore, but not cheap.

Even the rest of world is still not far off the top of the range of recent his

Read More, Comment and Share......

Global vs US PE10 Valuations: One of the most interesting aspects of the past decade has been the divergence in valuations between the USA and the rest of the world. A big part of the divergence in price/value has been driven by a massive divergence in relative earnings performance, with the US significantly and consistently outperforming the rest of the world in earnings growth…

But while the US has outperformed rest of world in earnings over the past decade, arguably this is already in the price and then some.

US PE10 valuations (i.e. price divided by trailing 10-year average earnings) are about double that of the rest of the world, and the breadth of overvaluation shows that it is a widespread issue (more than 90% of countries are at least 20% cheaper than the US by our calculations). One thing to note on this too is that such valuation gaps can partially close by the expensive one simply “catching down” or correcting further/faster than the other… and that seems to be happening as

Read More, Comment and Share......

Are we officially in the process of being caught off guard?

I wasn’t even going to write a note this morning, because it’s Sunday and I have a couple pieces planned for the week to come. But then I had an interesting set of realizations this morning while walking to get my coffee:

Many young people on Wall Street nowadays have never experienced real volatility in markets

Russia’s invasion of Ukraine and inflation at 7.5% in the U.S. are two extremely different, complex and unmapped pieces of terrain that we are going to be forced to navigate

In other words, we have a ton of inexperienced market participants that should be bracing for the economic shock of their lifetimes, but they’re not - they’re still at the stage where walking around Manhattan in Patagonia vests, drinking Starbucks and making dinner reservations at whatever douche-motel is trendy this week are among their top concerns.

This wasn’t a big deal when I first pointed out in November that I thought the NASDAQ could crash. We

Read More, Comment and Share......

Read More, Comment and Share......

iStock via Getty Images

- Things appear to be getting worse, not better, along the global supply chain, which was upended by the coronavirus pandemic over a year ago. That means entire companies and industries are going to have to deal with more extremes for the foreseeable future, making business investment a shaky decision that compounds the original problem. The volatility and uncertainty also destroy demand as prices become too high for consumers. The phenomenon, called the "bullwhip effect," could end up damaging the economy in the short-term, with violent swings in a range of goods. Seeking Alpha discussed the possibility back in May, but it looks like the situation is now in play.

- Warning bells: In an open letter to the United Nations General Assembly, business leaders from the International Chamber of Shipping, IATA and other transport groups (that account for more than $20T of annual global trade) sounded the alarm on the risks of a supply chain meltdown. "We are wit

Read More, Comment and Share......

- "The pace at which themes are transforming businesses is blistering, but the adoption of many technologies - like smartphones or renewable energy - have surpassed experts’ forecasts by decades, because we often think linearly but progress occurs exponentially."

- BofA Global Research strategists led by Haim Israel release a 152-page research report identifying 14 "radical technologies that could change our lives and accelerate the impact of global megatrends."

- They have a $330B market size today that could grow to $6.4T by the 2030s, Israel says.

- "These moonshots could transform and disrupt multiple industries, contributing to the next big cycle of technology-driven growth."

- The 14 are:

- 6G: "The next generation of telecom networks will be needed in less than a decade as data continues to grow exponentially and 5G reaches its upper limit capacity."

- Brain Computer Interfaces: "As we reach a point where humans are unable to keep up with computers and AI, brain computer interfaces could

Read More, Comment and Share......

Bitcoin’s Latest Crash: Not the First, Not the Last

Bitcoin’s Latest Crash: Not the First, Not the Last

While bitcoin has been one of the world’s best performing assets over the past 10 years, the cryptocurrency has had its fair share of volatility and price corrections.

Using data from CoinMarketCap, this graphic looks at bitcoin’s historical price corrections from all-time highs.

With bitcoin already down ~15% from its all-time high, Elon Musk’s tweet announcing Tesla would stop accepting bitcoin for purchases helped send the cryptocurrency down more than 50% from the top, dipping into the $30,000 price area.

“Tesla has suspended vehicle purchases using Bitcoin. We are concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel.”

– @Elonmusk

Crypto Cycle Top or Bull Run Pullback?

It’s far too early to draw any conclusions from bitcoin’s latest drop despite 30-40% pullbacks being common pit stops across bitcoin’s various bull runs.

While this d

Read More, Comment and Share......

From the bottom in late March of last year, the U.S. stock market was up nearly 75%. This was the best 12 month return ever recorded since 1950.

Nearly 96% of stocks in the overall U.S. stock market showed positive returns in that time.

It’s highly like we will never experience a 12 month period of returns like that again in our lifetime. For all intents and purposes, the one year period following the bottom of the Corona Crash was the easiest environment in history to make money in the stock market.

If you think this type of market is normal, you’re sorely mistaken. It’s not always going to be this easy.

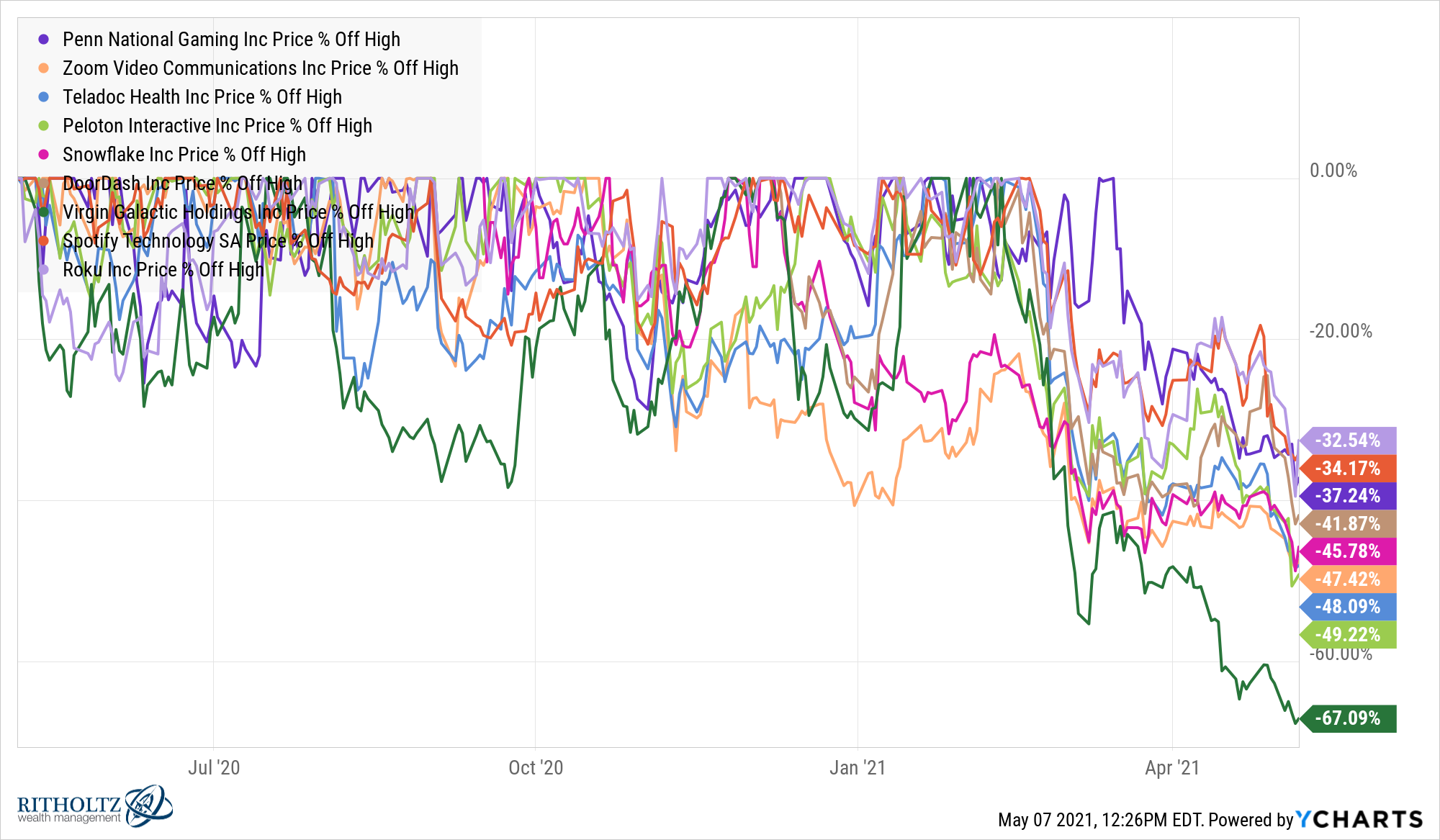

In fact, the stock market has already stopped being so easy in 2021. While the S&P 500 just hit its 26th new all-time high this year alone (including another new high at the close on Friday), a number of stocks are currently getting crushed.

And it’s not just any stocks; it’s many of the stocks retail investors flocked to last year following the crash:

https://awealthofcommonsense.com

https://awealthofcommonsense.com

Read More, Comment and Share......

Read More, Comment and Share......

Read More, Comment and Share......

For those who have not followed David Einhorn's crusade against central bank money printing, and the epic bubble these cluless academic hacks have created, his views on the "enormous tech bubble" we are currently living through and published in his latest letter to investors of his Greenlight hedge fund (which returned 5.9% in Q3) will provide some unique perspective.

To everyone else who is familiar with how his fund has been hammered by his tech short basket - and especially Tesla - over the years as the most overvalued tech stocks in history continued to rip higher year after year, we doubt his latest thoughts will come as a surprise, although his observations on the endgame are certainly remarkable, if for no other reason that he now declared the time of death of said "enormous tech bubble" as Sept 2, 2020.

Bubbles tend to topple under their own weight. Everybody is in. The last short has covered. The last buyer has bought (or bought massive amounts of weekly calls). The decline s

Read More, Comment and Share......

Read More, Comment and Share......

Read More, Comment and Share......

The Iran conflict notwithstanding, Mr. Market will do it's best to reassure you that everything will be fine. Only time will tell but I personally, would not want to enter any new positions here unless you're a daytrader. Not at 20x forward earnings already baked in. Watch the next plank of earning reports. Hedge if you are long any name...........except gold that is. I have a target of $1700 in a wave five count before a correction.

Read More, Comment and Share......

The idea that we are late in the economic and financial-market cycle is one that even most Wall Street bulls won’t dispute.

After all, when the economic expansion surpasses a decade to become the longest ever and the S&P 500 has delivered a compounded return of nearly 18% a year since March 2009, how can the cycle not be considered pretty mature?

Yet it’s not quite that simple. Huge parts of the economy have run out of sync, at separate speeds. Some indicators have a decidedly “good as it gets” look, others retain a mid-cycle profile — and a few even resemble early parts of a recovery than the end. Friday’s unexpectedly strong November job gain above 200,000 reflects this debate, suggesting we are not at “full employment” even this deep into an expansion.

And the market itself has stalled and retrenched several times along the way, keeping risk appetites tethered and purging or preventing excesses.

In the “late-cycle” category we find several broad, trending data readings: Unemploym

Read More, Comment and Share......

You can't use this site and its products or services without agreeing to the terms and conditions and privacy policy.

We welcome you to post a blog entry, oped or share your daily reading with us as long as it is relevant to the topic of investing and not an attempt to sell a product, proprietary strategy, platform or other service. Please provide links to any research data and if re-posting other articles, give credit where credit is due providing a back link to the original site.

300 words minimum per post. You may also sort by category or search by topic. Don't forget to comment and please "share" via Facebook, Twitter and Google+. If you have any questions, please contact us.

__________________