H/T Ryan

H/T Ryan

Read More, Comment and Share......

Read More, Comment and Share......

Read More, Comment and Share......

Read More, Comment and Share......

Read More, Comment and Share......

Read More, Comment and Share......

Read More, Comment and Share......

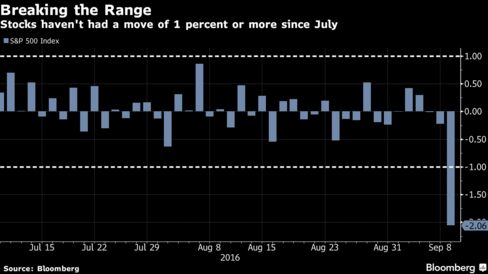

Tranquility that has enveloped global markets for more than two months was upended as central banks start to question the benefits of further monetary easing, sending government debt, stocks and emerging-market assets to the biggest declines since June. The dollar jumped.

The S&P 500 Index, global equities and emerging-market assets tumbled at least 2 percent in the biggest rout since Britain voted to secede from the European Union. The yield on the 10-year Treasury note jumped to the highest since June and the greenback almost erased a weekly slide as a Federal Reserve official warned waiting too long to raise rates threatened to overheat the economy. German 10-year yields rose above zero for the first time since July after the European Central Bank downplayed the need for more stimulus.

Fed Bank of Boston President Eric Rosengren’s comments moved him firmly into the hawkish camp, sending the odds for a rate hike this year above 60 percent. He spoke a day after ECB President Mario D

Read More, Comment and Share......

With disruptions fading and Libya now reaching a deal to end their brigade, oils top may be in for now. This man, however, feels it's going to be a very long road ahead for crude oil bulls.

Read More, Comment and Share......

Have you ever believed a trend is about to change but your basic, every day indicators don't quite support your theory so you insert different studies, looking for one or two which could support your thesis? Yes, soldier and scout mindsets affect your decision making when investing but remember, that's your theory. Does the rest of the crowd believe what you do?

Read More, Comment and Share......

Read More, Comment and Share......

Presented without commentary.

Read More, Comment and Share......

Has anything changed fundamentally or is this just a bear market rally? I haven't heard anything from the Fed but crude oil's short covering is definitely a driver. Ditto for retail seeing short covering ahead of tomorrows retail sales numbers. For 'how long' is open to speculation. Let's see what DeMark has to say.

Read More, Comment and Share......

I have a number of friends who collect antiques ranging from blue glass to old jewelry and oil paintings and road shows are always an attraction but never in my world have I encountered this. Amazing! Do you think he had any idea in the 1970s, just how much the attraction would become? Maybe I should go through my collectibles again.

Read More, Comment and Share......

There once was a series of interviews with Jim Cramer, as you'll see here where he talks about his days as a Hedge Fund Manager, and they were a wonder to behold. It seems many have been 'scrubbed' from the web (nice job Jim) but I came across this one and it'll give you a glimpse into the games that are played behind the scenes. CNBC and its cohorts are entertainment and easily swayed. Get your economic data and hit the 'mute' button. Opinions are swayed by the opinions’ of others but it doesn't make them fact. Learn this early.

Read More, Comment and Share......

Hat tip to BornBroke

Read More, Comment and Share......

Read More, Comment and Share......

The small-cap market finished 3Q15 with a double-digit decline, in many ways similar to the correction investors saw around this same time last year. CEO Chuck Royce sits down with Co-CIO Francis Gannon to discuss why he believes corrections are a sign of healthy market behavior, the importance of risk management in the small-cap space, and why he thinks a new market cycle will favor companies with earnings.

More at RoyceFunds

Read More, Comment and Share......

Read More, Comment and Share......

Read More, Comment and Share......

You can't use this site and its products or services without agreeing to the terms and conditions and privacy policy.

We welcome you to post a blog entry, oped or share your daily reading with us as long as it is relevant to the topic of investing and not an attempt to sell a product, proprietary strategy, platform or other service. Please provide links to any research data and if re-posting other articles, give credit where credit is due providing a back link to the original site.

300 words minimum per post. You may also sort by category or search by topic. Don't forget to comment and please "share" via Facebook, Twitter and Google+. If you have any questions, please contact us.

__________________