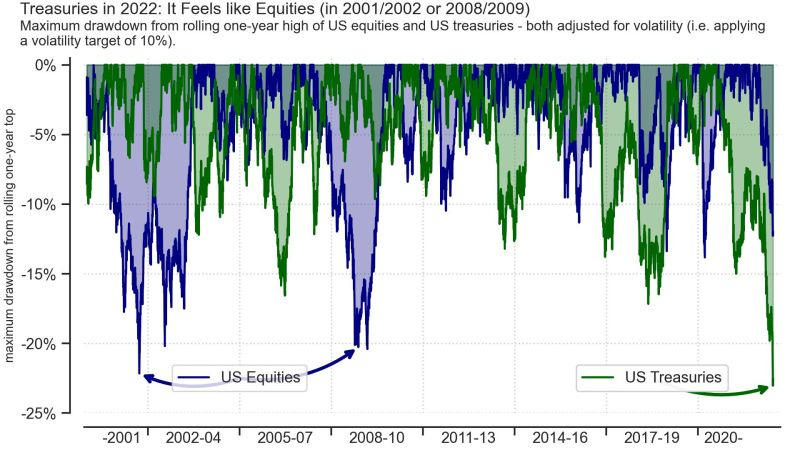

1. The Worst of Times: In hindsight, it was never going to end well when both stocks AND bonds were trading at crazy expensive levels. It is the worse case scenario for traditional passive buy and hold portfolios.

Source: Dr. Timo Teuber

2. Max Pain: Passive buy and hold + stocks and bonds down = portfolio pain. And it is showing up clearly in Google Trends data on searches for "why is 401k down".

Source: @Callum_Thomas Google Trends

3. Extreme Valuation Swinging: We’ve just witnessed an extremely rapid and substantial contraction in P/E multiples (which follows a previous extremely rapid and substantial expansion!). The question many will ask: "is it cheap yet?"

Source: @keyeventrisk

4. Is it Cheap Yet? In terms of levels, even though the US PE10 ratio has come down sharply, it is still some way off the bottoms seen in 2016/18/20. So I would say no, it is not cheap yet: not expensive anymore, but not cheap.

Even the rest of world is still not far off the top of the range of recent his