Read More, Comment and Share......

Read More, Comment and Share......

Maybe you've never heard of MMT (Modern Monetary Theory). But no doubt, as the 2020 election nears, you will. It's the latest contentious buzzword to hit Washington, D.C.

The idea, despite its name, is not new or "modern." But it has set off a heated political and economic debate, with Fed Chairman Jerome Powell telling Congress last week that Modern Monetary Policy is "just wrong."

Does Modern Monetary Theory, or MMT, represent a brave new future of ever-expanding government spending to meet Americans' vital needs? Or is it a dangerous idea that could lead to runaway inflation, financial disaster and, ultimately, collapse?

The theory, in a nutshell, says that because the U.S. can borrow in its own currency, it can simply print more money when it needs to pay off its debts. All the Fed has to do is keep interest rates low. Simple. It's an increasingly popular idea among left-leaning economists.

Fed Chairman Powell: MMT Is 'Just Wrong'

Not surprisingly, however, when Fed Chairman Powe

Read More, Comment and Share......

When we talk about the giant size of Apple, the fortune of Warren Buffett, or the massive amount of global debt accumulated – all of these things sound large, but they are actually extremely different in magnitude.

That’s why visualizing things spatially can give us a better perspective on money and markets.

This infographic was initially created to show how much money exists in its different forms. For example, to highlight how much physical cash there is in comparison to broader measures of money which include saving and checking account deposits.

Interestingly, what is considered “money” depends on who you are asking.

Are the abstractions created by Central Banks really money? What about gold, bitcoins, or other hard assets?

However, since we first released this infographic in 2015, “All the World’s Money and Markets” has taken on a different meaning to us and many others. It’s a way of simplifying a complex universe of currencies, assets, and ot

Read More, Comment and Share......

Iff you're hesitant to make stock purchases at these levels, you're not alone.

NEW POST: Why Warren Buffett Is So Reluctant To Call Stocks A ‘Bubble’ https://t.co/HSqxmgC6ep pic.twitter.com/BPSOjaioMX

— Jesse Felder (@jessefelder) March 1, 2017

Last week I updated the Warren Buffett yardstick, market cap-to-GNP. The only time it was ever higher than it is today was for a few months at the top of the dotcom mania.

The Most Broadly Overvalued Moment in Market History https://t.co/XleMnXh3NZ by @hussmanjp pic.twitter.com/AjviMnPt6U

— Jesse Felder (@jessefelder) March 7, 2017

However, when you look under the surface of the market-cap-weighted indexes at median valuations they are currently far more extreme than they were back then. As my friend John Hussman puts it, this is now “the most broadly overvalued moment in market history.”

Nothing to see here. Move along pic.twitter.com/ELZojkcElM

— Eric Pomboy (@epomboy) March 3, 2017

Another way to look at stock prices is in relation

Read More, Comment and Share......

Rules and regulations exist to let us know what behaviors we should expect from the people we do business with. Sometimes, good sense or social convention overtake these rules — and they don’t matter so much. Just about everyone wears seat-belts these days (we all know how much they improve our odds of survival in an accident); the ranks of underage smokers have plummeted (it’s no longer cool). Once the toothpaste is out of the tube, as they say, there’s no cramming it back in.

Such is the case with the Department of Labor’s fiduciary rule. On Friday, President Trump asked the Labor Department to review the rule, which requires brokers working with retirement savers to put the interest of their clients ahead of their own. After years of work on it, the regulation was finalized last year by the Obama administration.

At first blush, this looks like a big way the Trump administration could directly affect everyday investors. As it turns out, whether the fidicuary rule hurts you isn’t up

Read More, Comment and Share......

There is a global push by lawmakers to eliminate the use of physical cash around the world. This movement is often referred to as “The War on Cash”, and there are three major players involved:

1. The Initiators

Who?

Governments, central banks.

Why?

The elimination of cash will make it easier to track all types of transactions – including those made by criminals.

2. The Enemy

Who?

Criminals, terrorists

Why?

Large denominations of bank notes make illegal transactions easier to perform, and increase anonymity.

3. The Crossfire

Who?

Citizens

Why?

The coercive elimination of physical cash will have potential repercussions on the economy and social liberties.

Cash has always been king – but starting in the late 1990s, the convenience of new technologies have helped make non-cash transactions to become more viable:

By 2015, there were 426 billion cashless transactions worldwide

Read More, Comment and Share......

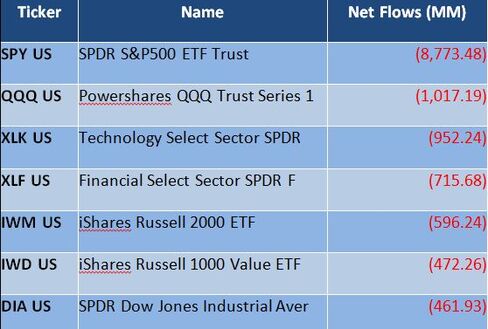

When first-generation ETFs launched in the 1990s—such as the SPDR S&P 500 Trust (SPY) and the PowerShares QQQ Trust Series 1 (QQQ)—lead this year's outflows, that is a sign that institutional investors are scared. These first-to-market ETFs have the ample liquidity that big institutions tend to love, with many trading more than $500 million in volume a day. While newer ETFs that may do the same thing or more for cheaper have been launched in the intervening years, early ETFs still tend to curry favor with large investors that value liquidity. These investors tend to be more tactical, and thus outflows from these ETF stalwarts are a bearish sign.

According to Bloomberg, when U.S. Treasury ETFs are the brightest bright spot, that's not good. They have taken in more than $3 billion in net new cash (while junk bond ETFs have seen $2 billion in outflows). What is especially bearish is that the inflows int

Read More, Comment and Share......

Read More, Comment and Share......

You can't use this site and its products or services without agreeing to the terms and conditions and privacy policy.

We welcome you to post a blog entry, oped or share your daily reading with us as long as it is relevant to the topic of investing and not an attempt to sell a product, proprietary strategy, platform or other service. Please provide links to any research data and if re-posting other articles, give credit where credit is due providing a back link to the original site.

300 words minimum per post. You may also sort by category or search by topic. Don't forget to comment and please "share" via Facebook, Twitter and Google+. If you have any questions, please contact us.

__________________