We’ve been bulls on 30-year Treasury bonds since 1981 when we stated, “We’re entering the bond rally of a lifetime.” It’s still under way, in our opinion. Their yields back then were 15.2%, but our forecast called for huge declines in inflation and, with it, a gigantic fall in bond yields to our then-target of 3%.

We’ve been bulls on 30-year Treasury bonds since 1981 when we stated, “We’re entering the bond rally of a lifetime.” It’s still under way, in our opinion. Their yields back then were 15.2%, but our forecast called for huge declines in inflation and, with it, a gigantic fall in bond yields to our then-target of 3%.

The Cause of Inflation

We’ve argued that the root of inflation is excess demand, and historically it’s caused by huge government spending on top of a fully-employed economy. That happens during wars, and so inflation and wars always go together, going back to the French and Indian War, the Revolutionary War, the War of 1812, the Mexican War of 1846, the Civil War, the Spanish American War of 1898, World Wars I and II and the Korean War. In the late 1960s and 1970s, huge government spending, and the associated double-digit inflation (Chart 1), resulted from the Vietnam War on top's LBJ’s War on Poverty.

By the late 1970s, however, the frustrations over military stalemate and loss of American lives in Vietnam as well as the failures of the War on Poverty and Great Society programs to propel lower-income folks led to a rejection of voters’ belief that government could aid Americans and solve major problems. The first clear manifestation of this switch in conviction was Proposition 13 in California, which limited residential real estate taxes. That was followed by the 1980 election of Ronald Reagan, who declared that government was the basic problem, not the solution to the nation’s woes.

This belief convinced us that Washington’s involvement in the economy would atrophy and so would inflation. Given the close correlation between inflation and Treasury bond yields (Chart 1), we then forecast the unwinding of inflation—disinflation—and a related breathtaking decline in Treasury bond yields to 3%, as noted earlier. At that time, virtually no one believed our forecast since most thought that double-digit inflation would last indefinitely.

Lock Up For Infinity?

Despite the high initial yields on “the long bond,” as the most-recently issued 30-year Treasury is called, our focus has always been on price appreciation as yields drop, not on yields, per se. A vivid example of this strategy occurred in March 2006—before the 2007–2009 Great Recession promoted the nosedive in stocks and leap in Treasury bond prices. I was invited by Professor Jeremy Siegel of Wharton for a public debate on stocks versus bonds. He, of course, favored stocks and I advocated Treasury bonds.

At one point, he addressed the audience of about 500 and said, “I don’t know why anyone in their right mind would tie up their money for 30 years for a 4.75% yield [the then-yield on the 30-year Treasury].” When it came my turn to reply, I asked the audience, “What’s the maturity on stocks?” I got no answer, but pointed out that unless a company merges or goes bankrupt, the maturity on its stock is infinity—it has no maturity. My follow-up question was, “What is the yield on stocks?” to which someone correctly replied, “It’s 2% on the S&P 500 Index.”

So I continued, “I don’t know why anyone would tie up money for infinity for a 2% yield.” I was putting the query, apples to apples, in the same framework as Professor Siegel’s rhetorical question. “I've never, never, never bought Treasury bonds for yield, but for appreciation, the same reason that most people buy stocks. I couldn't care less what the yield is, as long as it's going down since, then, Treasury prices are rising.”

Of course, Siegel isn’t the only one who hates bonds in general and Treasuries in particular. And because of that, Treasurys, unlike stocks, are seldom the subject of irrational exuberance. Their leap in price in the dark days in late 2008 (Chart 2) is a rare exception to a market that seldom gets giddy, despite the declining trend in yields and related decline in prices for almost three decades.

Treasury Haters

Stockholders inherently hate Treasurys. They say they don’t understand them. But their quality is unquestioned, and Treasurys and the forces that move yields are well-defined—Fed policy and inflation or deflation (Chart 1) are among the few important factors. Stock prices, by contrast, depend on the business cycle, conditions in that particular industry, Congressional legislation, the quality of company management, merger and acquisition possibilities, corporate accounting, company pricing power, new and old product potentials, and myriad other variables.

Also, many others may see bonds—except for junk, which really are equities in disguise—as uniform and gray. It's a lot more interesting at a cocktail party to talk about the unlimited potential of a new online retailer that sells dog food to Alaskan dogsledders than to discuss the different trading characteristics of a Treasury of 20- compared to 30-year maturity. In addition, many brokers have traditionally refrained from recommending or even discussing bonds with clients. Commissions are much lower and turnover tends to be much slower than with stocks.

Stockholders also understand that Treasurys normally rally in weak economic conditions, which are negative for stock prices, so declining Treasury yields are a bad omen. It was only individual investors’ extreme distaste for stocks in 2009 after their bloodbath collapse that precipitated the rush into bond mutual funds that year. They plowed $69 billion into long-term municipal bond funds alone in 2009, up from only $8 billion in 2008 and $11 billion in 2007.

Another reason is that most of those promoting stocks prefer them to bonds is because they compare equities with short duration fixed-income securities that did not have long enough maturities to appreciate much as interest rates declined since the early 1980s.

Investment strategists cite numbers like a 6.7% annual return for Treasury bond mutual funds for the decade of the 1990s while the S&P 500 total annual return, including dividends, was 18.1%. But those government bond funds have average maturities and durations far shorter than on 30-year coupon and zero-coupon Treasurys that we favor and which have way, way outperformed equities since the early 1980s.

Media Bias

The media also hates Treasury bonds, as their extremely biased statements reveal. The June 10 edition of The Wall Street Journal stated: “The frenzy of buying has sparked warnings about the potential of large losses if interest rates rise. The longer the maturity, the more sharply a bond’s price falls in response to a rise in rates. And with yields so low, buyers aren’t getting much income to compensate for that risk.” Since then, the 30-year Treasury yield has dropped from 2.48% to 2.21% as the price has risen by 8.3%.

Then, the July 1 Journal wrote: “Analysts have warned that piling into government debt, especially long-term securities at these slim yields, leaves bondholders vulnerable to the potential of large capital losses if yields march higher.” Since then, the price of the 30-year Treasury has climbed 1.7%.

While soft-pedaling the tremendous appreciation in long-term sovereigns this year, Wall Street Journal columnist James MacKintosh worries about the reverse. On July 28, he wrote, “Investors are taking a very big risk with these long-dated assets....Japan's 40-year bond would fall 15% in price if the yield rose by just half a percentage point, taking it back to where it stood in March. If yields merely rise back to where they started the year, it would be catastrophic for those who have chased longer duration. The 30-year Treasury would lose 14% of its value, while Japan's 40-year would lose a quarter of its value.”

The July 11 edition of the Journal said, “Changes in monetary policy could also trigger potential losses across the sovereign bond world. Even a small increase in interest rates could inflict hefty losses on investors.”

But in response to Brexit, the Bank of England has already eased, not tightened, credit, with more likely to follow. The European Central Bank is also likely to pump out more money as is the Bank of Japan as part of a new $268 billion stimulus package. Meanwhile, even though Fed Chairwoman Yellen has talked about raising interest rates later this year, we continue to believe that the next Fed move will be to reduce them.

Major central banks have already driven their reference rates to essentially zero and now negative in Japan and Europe (Chart 3) while quantitative easing exploded their assets (Chart 4). The Bank of England immediately after Brexit moved to increase the funds available for lending by U.K. banks by $200 billion. Earlier, on June 30, BOE chief Mark Carney said that the central bank would need to cut rates “over the summer” and hinted at a revival of QE that the BOE ended in July 2012.

Lonely Bulls

We’ve been pretty lonely as Treasury bond bulls for 35 years, but we’re comfortable being in the minority and tend to make more money in that position than by running with the herd. Incidentally, we continue to favor the 30-year bond over the 10-year note, which became the benchmark after the Treasury in 2001 stopped issuing the “long bond.” At that time, the Treasury was retiring debt because of the short-lived federal government surpluses caused by the post–Cold War decline in defense spending and big capital gains and other tax collections associated with the Internet stock bubble.

But after the federal budget returned to deficits as usual, the Treasury resumed long bond issues in 2006. In addition, after stock losses in the 2000–2002 bear market, many pension funds wanted longer-maturity Treasurys to match against the pension benefit liability that stretched further into the future as people live longer, and they still do.

Maturity Matters

We also prefer the long bond because maturity matters to appreciation when rates decline. Because of compound interest, a 30-year bond increases in value much more for each percentage point decline in interest rates than does a shorter maturity bond (Chart 5).

Note (Chart 6) that at recent interest rates, a one percentage point fall in rates increases the price of a 5-year Treasury note by about 4.8%, a 10-year note by around 9.5%, but a 30-year bond by around 24.2%. Unfortunately, this works both ways, so if interest rates go up, you’ll lose much more on the bond than the notes if rates rise the same for both.

If you really believe, as we have for 35 years, that interest rates are going down, you want to own the longest-maturity bond possible. This is true even if short-term rates were to fall twice as much as 30-year bond yields. Many investors don’t understand this and want only to buy a longer-maturity bond if its yield is higher.

Others only buy fixed-income securities that mature when they need the money back. Or they'll buy a ladder of bonds that mature in a series of future dates. This strikes us as odd, especially for Treasurys that trade hundreds of billions of dollars’ worth each day and can be easily bought and sold without disturbing the market price. Of course, when you need the cash, interest rates may have risen and you’ll sell at a loss, whereas if you hold a bond until it matures, you’ll get the full par value unless it defaults in the meanwhile. But what about stocks? They have no maturity so you’re never sure you’ll get back what you pay for them.

Three Sterling Qualities

We’ve also always liked Treasury coupon and zero-coupon bonds because of their three sterling qualities. First, they have gigantic liquidity with hundreds of billions of dollars’ worth trading each day, as noted earlier. So all but the few largest investors can buy or sell without disturbing the market.

Second, in most cases, they can’t be called before maturity. This is an annoying feature of corporate and municipal bonds. When interest rates are declining and you’d like longer maturities to get more appreciation per given fall in yields, issuers can call the bonds at fixed prices, limiting your appreciation. Even if they aren’t called, callable bonds don’t often rise over the call price because of that threat. But when rates rise and you prefer shorter maturities, you’re stuck with the bonds until maturity because issuers have no interest in calling them. It’s a game of heads the issuer wins, tails the investor loses.

Third, Treasurys are generally considered the best-quality issues in the world. This was clear in 2008 when 30-year Treasurys returned 42%, but global corporate bonds fell 8%, emerging market bonds lost 10%, junk bonds dropped 27%, and even investment-grade municipal bonds fell 4% in price.

Slowing global economic growth and the growing prospects of deflation are favorable for lower Treasury yields. So is the likelihood of further ease by central banks, including even a rate cut by the Fed, as noted earlier.

Along with the dollar (Chart 7), Treasurys are at the top of the list of investment safe havens as domestic and foreign investors, who own about half of outstanding Treasurys, clamor for them.

Sovereign Shortages

Furthermore, the recent drop in the federal deficit has reduced government funding needs so the Treasury has reduced the issuance of bonds in recent years. In addition, tighter regulators force U.S. financial institutions to hold more Treasurys.

Also, central bank QE has vacuumed up highly-rated sovereigns, creating shortages among private institutional and individual buyers. The Fed stopped buying securities in late 2014, but the European Central Bank and the Bank of Japan, which already owns 34% of outstanding Japanese government securities, are plunging ahead. The resulting shortages of sovereigns abroad and the declining interest rates drive foreign investors to U.S. Treasurys.

Also, as we’ve pointed out repeatedly over the past two years, low as Treasury yields are, they’re higher than almost all other developed country sovereigns, some of which are negative (Chart 8). So an overseas investor can get a better return in Treasurys than his own sovereigns. And if the dollar continues to rise against his home country currency, he gets a currency translation gain to boot.

"The Bond Rally of a Lifetime"

We believe, then, that what we dubbed “the bond rally of a lifetime” 35 years ago in 1981 when 30-year Treasurys yielded 15.2% is still intact. This rally has been tremendous, as shown in Chart 9, and we happily participated in it as forecasters, money managers and personal investors.

Chart 9 uses 25-year zero-coupon bonds because of data availability but the returns on 30-year zeros were even greater. Even still, $100 invested in that 25-year zero-coupon Treasury in October 1981 at the height in yield and low in price and rolled over each year maintains its maturity or duration to avoid the declining interest rate sensitivity of a bond as its maturity shortens with the passing years. It was worth $31,688 in June of this year, for an 18.1% annual gain. In contrast, $100 invested in the S&P 500 index at its low in July 1982 is now worth $4,620 with reinvested dividends. So the Treasurys have outperformed stocks by 7.0 times since the early 1980s.

So far this year, 30-year zero-coupon Treasurys have returned 26% compared to 3.8% for the S&P 500. And we believe there’s more to go. Over a year ago, we forecast a 2.0% yield for the 30-year bond and 1.0% for the 10-year note. If yields fall to those levels by the end of the year from the current 2.21% and 1.5%, respectively, the total return on the 30-year coupon bond will be 5.7% and 5.6% on the 10-year note. The returns on zero-coupon Treasurys with the same rate declines will be 6.4% and 5.1% (Chart 10).

Besides Treasurys, sovereign bonds of other major countries have been rallying this year as yields fell (Chart 11) and investors have stampeded into safe corrals after Brexit.

Finally Facing Reality

Interestingly, some in the media are finally facing the reality of this superior performance of Treasury bonds and backpedaling on their 35-year assertions that it can’t last. The July 12 Wall Street Journal stated: “Bonds are churning out returns many equity investors would envy. Remarkably, more than 80% of returns on U.S., German, Japanese and U.K. bonds are attributable to gains in price, Barclays index data show. Bondholders are no longer patient coupon-clippers accruing steady income.”

The July 14 Journal said, “Ultra low interest rates are here to stay,” and credited not only central bank buying of sovereigns but also slow global growth. Another Journal article from that same day noted that central banks can make interest rates even more negative and, if so, “even bonds bought at today’s low rates could go up in price.” And in the July 16 Journal, columnist Jason Zweig wrote, “The generation-long bull market in bonds is probably drawing to a close. But high quality bonds are still the safest way to counteract the risk of holding stocks, as this year’s returns for both assets has shown. Even at today’s emaciated yields, bonds still are worth owning.” What a diametric change from earlier pessimism on bonds!

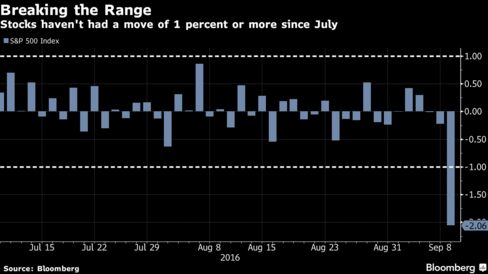

The July 11 Journal said, “Recently, the extra yield investors demand to hold the 10-year relative to the two-year Treasury note hit its lowest level since November 2007 (Chart 12). In the past, investors have taken this narrowing spread as a warning sign that growth momentum may soon slow because the Fed is about to raise interest rates—a move that would cause shorter-dated bond yields to rise faster than longer-dated ones. Now, like much else, it is largely being blamed on investors’ quest for yield.” Note (Chart 12) that when the spread went negative, with 2-year yields exceeding those on 10-year Treasury notes, a recession always followed. But that was because the Fed's attempts to cool off what it saw as an overheating economy with higher rates was overdone, precipitating a business downturn. That's not li kely in today's continuing weak global economy.

Persistent Stock Bulls

Nevertheless, many stock bulls haven’t given up their persistent love of equities compared to Treasurys. Their new argument is that Treasury bonds may be providing superior appreciation, but stocks should be owned for dividend yield.

That, of course, is the exact opposite of the historical view, but in line with recent results. The 2.1% dividend yield on the S&P 500 exceeds the 1.50% yield on the 10-year Treasury note and is close to the 2.21% yield on the 30-year bond. Recently, the stocks that have performed the best have included those with above average dividend yields such as telecom, utilities and consumer staples (Chart 13).

Then there is the contention by stock bulls that low interest rates make stocks cheap even through the S&P 500 price-to-earnings ratio, averaged over the last 10 years to iron out cyclical fluctuations, now is 26 compared to the long-term average of 16.7(Chart 14). This makes stocks 36% overvalued, assuming that the long run P/E average is still valid. And note that since the P/E has run above the long-term average for over a decade, it will fall below it for a number of future years—if the statistical mean is still relevant.

Instead, stock bulls points to the high earnings yield, the inverse of the P/E, in relation to the 10-year Treasury note yield. They believe that low interest rates make stocks cheap. Maybe so, and we’re not at all sure what low and negative nominal interest rates are telling us.

We’ll know for sure in a year or two. It may turn out to be the result of aggressive central banks and investors hungry for yield with few alternatives. Or low rates may foretell global economic weakness, chronic deflation and even more aggressive central bank largess in response. We’re guessing the latter is the more likely explanation.

Courtesy of A.GaryShilllingsInsight

Guggenheim Currency Shares Japanese Yen ETF (FXY) is an investment that seeks to track the Japanese Yen. Traders will buy the Yen in expectation that it will rise against the Euro, the Pound and the Dollar. Yen momentum has been a concern and a risk-off type scenario could give the currency an extra push higher as global markets head lower.

Guggenheim Currency Shares Japanese Yen ETF (FXY) is an investment that seeks to track the Japanese Yen. Traders will buy the Yen in expectation that it will rise against the Euro, the Pound and the Dollar. Yen momentum has been a concern and a risk-off type scenario could give the currency an extra push higher as global markets head lower.