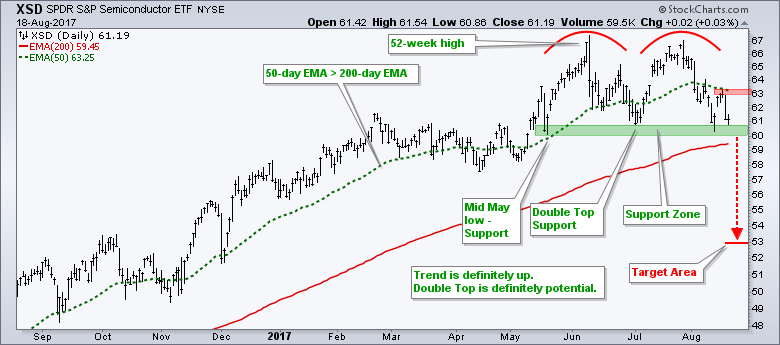

Doubles Tops are forming in two key ETFs, the Semiconductor SPDR (XSD) and the Consumer Discretionary SPDR (XLY), and chartists should watch these important groups for clues on broad market direction in the coming week or two. First, let's talk about the Double Top. These patterns form with two peaks near the same level and an intermittent trough that marks support. A break below support confirms the pattern and targets a move based on the height of the pattern.

Achtung! A Double Top is just a POTENTIAL Double Top until confirmed with a break below the intermittent low. In other words, the trend is still up as long as support holds. Furthermore, Double Tops are bearish reversal patterns and trend continuations are more likely that trend reversals.

The chart above shows a potential Double Top brewing in XSD over the last three months or so. Because this is an ETF with dozens of moving parts (components), I am marking a support zone using the mid May low and the June low. A close belo