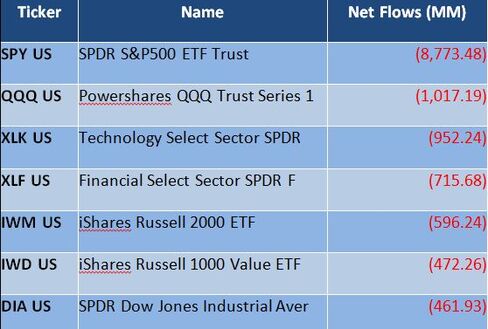

U.S. stocks experienced their third straight week of gains, with the S&P 500 Index rising 2.6% and gaining more than 10% since Christmas Day.1 Investors were encouraged by comments from the Federal Reserve indicating a less aggressive policy stance and a sense that trade issues may be improving. Strong outflows from stock funds have also been an important contrarian indicator that investor capitulation had reached a limit. Several market areas were standout performers last week, including industrials, retail sectors, technology and energy, which was helped by a 7.5% climb in oil prices.1 A near -term consolidation is possible, given the strong climb over the last few weeks, but a return to December’s lows seems unlikely.

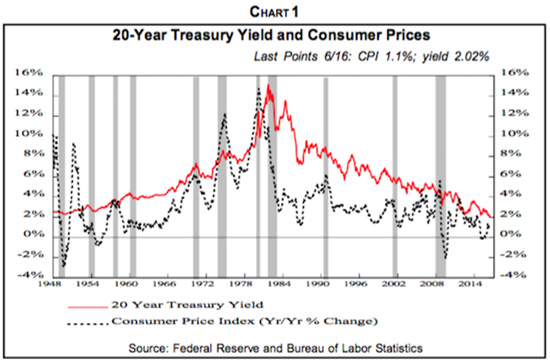

1. The Fed should remain data dependent, which should be good for stocks. Fed comments in October seemed to indicate it would continue to raise rates and sell off its balance sheet for the foreseeable future. But Fed Chair Jerome Powell walked back those comments in