Read More, Comment and Share......

housing (9)

As German bond yields breach unthinkable levels, BK was struck by a chart from Deutsche Bank – it is a chart of German yields since 1807.

Take a moment to reflect on this chart – in over 200 years, German bond yields have never been lower. This period of time includes such notable and notorious events as:

- US Civil War

- The British Railway Mania Bubble

- The Panic of 1873 and The Long Global Depression

- Industrial Revolution

- Thomas Edison’s Invention of Electric Light

- Invention of the Automobile

- Stock Market Panic of 1907

- World War I

- 1929 Stock Market Crash

- The Depression of the 1930’s

- World War II

- Japan’s Real Estate Bubble and Crash

- The Dot-Com Bubble

- 1987 US Stock Market Crash

- 1997 Asian Currency Crisis

- 1998 Russian Default and Long Term Capital Management Bailout

- 9/11

- The US Housing Bubble and 2008 Great Financial Crisis

During each of these spectacular and horrific events, German bond yields managed to stay in a range of roughly 4-10% with the occasional spike up or down. However du

Read More, Comment and Share......

(Edited 2:00pm) I especially enjoy the part when the commentator withdrew his request for an interview after Schiff refused to blame everything on China. Yes, MSM wants us to believe it's all China's fault. Don't drink the koolaid. Use your head.

Hat tip Ed

Read More, Comment and Share......

In my typical day I read 20+ articles pertaining to the the stock market and investing. Only occasionally posting one here which stands out in my mind but one yesterday at Sober Look caught my eye. It's author begins right off the bat with "The United States is not building enough homes to meet the nation's housing demand." and I almost spit out my tea. Not building enough homes when you compare the aging ones being thrown out versus the new ones being constructed or are we looking at what a consumer can afford to buy? He is clearly in the camp that we should crank out more housing which would cause prices to drop at some point and suddenly "Joe the Plumber" will move out of his apartment an into a new home. I simply don't buy that scenario.

Anyone with even a little information on the market knows that the middle class has been hallowed out (and may continue) and guess what? Those lost jobs, whether lost to technological advances or shipped overseas, are NOT coming back. Perio

Read More, Comment and Share......

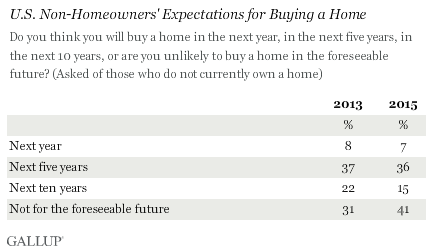

More Americans who do not currently own a home say they do not think they will buy a home in "the foreseeable future," 41%, vs. 31% two years ago. Non-homeowners' expectations of buying a house in the next year or five years have stayed essentially the same, suggesting little change in the short-term housing market. As a result, what may have been a longer-term goal for many may now not be a goal at all, and this could have an effect on the longer-term housing market.

One of the long-running facets of the "American Dream" has been the ability to buy a house. Yet seven years after the housing market crashed in 2007-2008, it appears that a renewal of zeal for home buying may not yet be evident in the United States. Two years ago, Gallup asked those who did not own a home in the U.S. whether they thought they would buy a house in various time periods in the future. The current Gallup poll shows little movement in Americans' opinions since 2013, except in the sentiment that those who do n

Read More, Comment and Share......

For the love of Pete. I can only imagine what's going through the minds of investors. First fears of energy name defaults and now China's real estate (bubble) may have it's first big default? It'll be a fun Sunday night when futures open.

The Chinese real-estate developer Kaisa Group Holdings had a healthy balance sheet, according to investors and observers alike. It was the top-rated residential-property-sales firm in the city of Shenzhen, in the first half of 2014. It was known for fast, reliable work.

But on Thursday, Kaisa appeared to become the first Chinese development firm to default on offshore debt, missing a $128 million interest payment on $500 million of debt to foreign investors. Representatives of the company say they aren't sure whether the payment was made, The Wall Street Journal reports.

Consider this a slap in the face to investors chasing yield around the world and finding it (or so they think) in emerging-market junk bonds. Back in 2013, Kaisa and its fellow C

Read More, Comment and Share......

Sadly wage growth......is not growing so does anyone see a resolution to this "underwater" problem other than time? From Forbes:

A total of 9.7 million American households still have “underwater” mortgages, meaning they owe more on the home than it is currently worth. Homes in the lowest price tier are most affected, according to data released today from Zillow.

Thirty percent of homes in the bottom price tier are in negative equity, while only 18.1% of homes in the middle tier and 10.7% in top tier are underwater, according to Zillow’s Negative Equity Report. Homes are defined as top, middle, or bottom tier based on their estimated value compared to the median home price for that area. (Nationally, the median price in the top tier is $306,700; middle tier, $163,400; bottom, $98,400.)

Overall, 18.8% of homeowners were underwater during the first quarter of 2014.

Zillow’s figures for homes with negative equity are higher than other recent reports looking at the same problem.

Read More, Comment and Share......

This visual gives one a clear perspective on what housing areas were hit the hardest during the recent financial crisis and subsequent housing (price) fall. The recovery in some areas has been amazing.

Created by Catherine Mulbrandon at VisualizingEconomics.com

Read More, Comment and Share......

The new home market, held down by high prices and low supply of units, appears to be stalling further, not accelerating, as the spring unfolds. The housing market index fell 1 point to 45 which is 3 points below the low-end forecast. And weakness is centered in current sales, down 2 points to 48 in a reading that points to further trouble for new home sales.

But expectations for future sales are strong, up 1 point to 57, while traffic is weak but improving, up 2 points to 33. Breakdowns show mid-to-high 40 readings for all regions except the Northeast which is by far the smallest region for new home sales and is lagging badly.

The new home market in general has been lagging badly, lagging both the economy and holding down the housing sector. March new home sales fell a very surprising 14.5 percent in March and today's report doesn't point to much improvement for April and May.

The "new normal"? With new job creation being either at the very low end, or very high end of the pay range

Read More, Comment and Share......

You can't use this site and its products or services without agreeing to the terms and conditions and privacy policy.

We welcome you to post a blog entry, oped or share your daily reading with us as long as it is relevant to the topic of investing and not an attempt to sell a product, proprietary strategy, platform or other service. Please provide links to any research data and if re-posting other articles, give credit where credit is due providing a back link to the original site.

300 words minimum per post. You may also sort by category or search by topic. Don't forget to comment and please "share" via Facebook, Twitter and Google+. If you have any questions, please contact us.

__________________