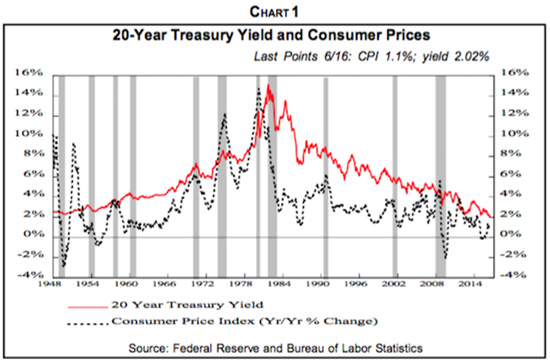

We’ve been bulls on 30-year Treasury bonds since 1981 when we stated, “We’re entering the bond rally of a lifetime.” It’s still under way, in our opinion. Their yields back then were 15.2%, but our forecast called for huge declines in inflation and, with it, a gigantic fall in bond yields to our then-target of 3%.

The Cause of Inflation

We’ve argued that the root of inflation is excess demand, and historically it’s caused by huge government spending on top of a fully-employed economy. That happens during wars, and so inflation and wars always go together, going back to the French and Indian War, the Revolutionary War, the War of 1812, the Mexican War of 1846, the Civil War, the Spanish American War of 1898, World Wars I and II and the Korean War. In the late 1960s and 1970s, huge government spending, and the associated double-digit inflation (Chart 1), resulted from the Vietnam War on top's LBJ’s War on Poverty.

By the late 1970s, however, the frustrations over military stalemat