Read More, Comment and Share......

StockBuz's Posts (693)

These are simple but they changed my trading immensely. What tip (or 2) would you give to a new investor or trader?

How many times has this happened to you? You're "in" a stock certain you're certain it's a winner. You place a $1.00 stop because after all you don't want to lose more than $100.

The next thing you know you're stopped out, only to see it reverse and head higher without you. Was it your execution? Is the market a rigged game? Are they out to get you.....or was it the $100 you were willing to risk? Was it, in fact, large enough?

Here are a few basics I've learned since I began actively trading:

- I don't buy a the open. I wait for the opening drive to dip down, possibly even test the prior days mid-to low area OR I have a standing order waiting at a major moving average or fibonacci area (I love fibonacci!).

- I had to erase the thought of risking $1.00 on a trade (unless it's a small stock). Period. Zip. Hands down. Put it out of my head. After all, in any given week a $40 stock can pullback or fluctuate up/down 1-5% meaning (unless you're a rockstar at your entry) you're stopped out - and then it resumes heading higher with you in the dust.

Now I use technical analysis in my trading but that alone doesn't guaranty one a winner. While stops can limit losses, they actually work against you in many cases. In fact, I finally stopped using stop orders altogether because MM (Market Markers) see your stop and when at all possible, they invariably reach out and slap you silly, hit your order (providing liquidity dontcha' know) then go about their merry way.

Sure your broker may have triggers and multiple layer orders such as OCA (one cancels another) orders but for my broker (AMTD) they're very inconveniently located at their website and not on my trading platform. I have no time or patience for such silliness so I use Alerts.

I began using a 10% stop (less at times but almost always more than $1.00) and placing alerts (rather than actual stop orders) as soon as my trade was entered. Alerts telling me when to take partial profits and when I was close to my stop out point. Then I sit back...........and do absolutely nothing.

My stress levels plummeted. No longer do I worry about being stopped out. My percentage of winners have skyrocketed and not because of QE lifting the markets (they went up before the credit crisis). It's because time and time again MM couldn't reach out and grab me and I was no longer being taken out by a pullback. My losers became few. Again because my tolerance was wider, I stayed in the game.

Just where I placed my stops is an entirely different conversation but just staying in the game is an enormous struggle for young traders. I encourage papertrading with these simple methods and see if your results, bottom line and stress levels improve.

I'm continually taking partials along the way; banking profits at fib levels. No more watching a name reverse and thinking "damn, there go my profits" after the fact. My winners are all waiting for a correction to re-add shares so come on Mr. Market; bring it.

Sure my morning's can be a little crazy with bells ringing as Alerts are tripped at the open (or at the close for that matter) but my trading day is filled with research, common household tasks or running errands......and not watching my screens. Less stress, oh yes, it's a wonderful thing.

What tips would you recommend to a novice trader? What have you changed in your investment style? What have you gotten rid of?

Read More, Comment and Share......

The debate continues whether China will return to it's incredible 10% GDP pre-crisis highs with voracious appetite for all things commodity. Or whether given their own housing bubble (with empty subdivisions, malls, amusements parks and college campus's yet to be occupied) will their monetary policy now keep them on more of a sustained 7-8% path going forward.

Africa, in the meantime, continues to grow. Indeed the IMF recently predicted Ruwanda's economy to grow by over 7% in 2013. Although global slowdowns and funding due to Rebel support weighs heavily on the numbers, this type of growth is not to be dismissed (imo) . For your consideration, I submit this McKinsey quarterly article on What's Driving Africa's Growth? and ask you: Is Africa The New China?:

To be sure, Africa has benefited from the surge in commodity prices over the past decade. Oil rose from less than $20 a barrel in 1999 to more than $145 in 2008. Prices for minerals, grain, and other raw materials also soared on rising global demand.

Yet the commodity boom explains only part of Africa’s broader growth story. Natural resources, and the related government spending they financed, generated just 32 percent of Africa’s GDP growth from 2000 through 2008.2 The remaining two-thirds came from other sectors, including wholesale and retail, transportation, telecommunications, and manufacturing (Exhibit 1). Economic growth accelerated across the continent, in 27 of its 30 largest economies. Indeed, countries with and without significant resource exports had similar GDP growth rates. Read more @ McKinsey quarterly.

Read More, Comment and Share......

This in follow up to my February post pondering if the shipping index had bottomed which was most definitely chucked in to the round file by most as the market has become convinced the industry is dead. I still beg to differ.

Being a big believer in moving averages, if I see a stock or Index with rising moving averages, I take it as a sign of buying within a name. That being said, if I see falling longer term moving averages (100d and 200d), that to me signals trouble; stay away or short any pop. However when I see longer term MA's flattening.......my curiosity is peaked from a bottom fishing point of view. My first thought "is the bad news over and is it putting in a bottom?

After writing my February post, I put my money where my mouth was and bought $NAT looking for a reversal out of it's bottom (which it did) and today it absolutely plowed through it's 200d where I banked partial.

Do I believe that it will hold? No. With so many shorts it's certain to be faded *and* as most breakouts test their supports, it will as well. Will I be adding more on that test? You betcha. Do I think it'll shoot back up to the highs? Hell no and I can't believe you would ask that. This is definitely a short squeeze and it doesn't bother me one bit. Shippers definitely face a great deal of headwinds as they attempt to pass on higher prices to their customers however if the majority of the new vessels have been received, if they continue to retire old ones shrinking their fleet and if they've re-negotiated the terms of their (heavy) debt given such lower interest rates, I do not see any reason why the bottom is not truly in. At the very least, the moving averages will become my support as they continue to flatten with my stop below the January low and a partial already banked. Yes, like going to an AA meeting, my name is Kos, and I like to bottom fish.

Read More, Comment and Share......

Meet "Curt" who, as credit lines worldwide were tightening, lost his middle management job in finance in 2006. Of course Curt had no idea of what was to come. He was a good worker, great work and credit history and was lucky to have a nice nest egg saved up. He wouldn't need unemployment, no. He'd have a job in no time so he did what every good American in his position would do. He dusted off his resume, began to network/emailing his resume and paid his bills using his hard earned savings and waited.......for a job that would never come.

Then bubble burst. The market began it's long downwards spiral but Curt, undaunted, continued emailing and living off of his savings....and still did not file for unemployment. Surely something will turn up any day now, he told himself.

For four years.

Four years of bank failures, branch closings, massive consolidations and layoffs.

By 2010 the stock market was clearly rebounding however it was all over for Curt. After four long years he had drained his savings, cashed in his CDs, sold his 2nd car and withdrawn his 401k's one by one until there were no more. Even if he wanted to get back into the market to raise cash, there was no cash left to invest. His family wasn't in any better shape. There was no one to borrower from. Too late to file for unemployment now. That window was closed. His life was collapsing further. His once 760 credit score, was now sub 600. He could scarcely afford his utilities much less his mortgage. He did the only thing left to him. He sought counsel of an Attorney file to Chapter 7 (no assets).

The Lawyer, hearing Curt's plea to somehow keeps his home, advised if he felt he was going to have his mortgage modified, he could leave the house out of the Chapter 7; reaffirm with the lender and therefore not be evicted. If included in the Chapter 7, Steve would have to vacate the property within 30 days of the final filing. Steve had no where else to go and his lender had be so reassuring that he'd be granted a modification. He took the bait - reaffirmed with his lender and filed the Chapter 7. After all, he didn't want to lose his home and he was certain something would turn up soon.

Oh poor Curt.

Having no job (and no unemployment income) he was denied for a loan modification.

Badly upside down in debt now, he hosted what seemed to be a perpetual garage sale to keep the lights on and food on the table. Selling his tools, furniture, guns, even his pool in the yard simply to keep on going. His attempt to sell his home on a short sale was rejected. You see Curt had a 2nd lien holder who would receive absolutely nothing under the proposal AND to add insult to injury he now had enormous tax liens; a result of liquidating his 401k's and not being able to cover the tax on same.

The Spring of 2011 Curt finally gave up. Temp agencies were not even returning his call. Just sending him email links to apply. With his skills five years dormant and his credit destroyed, he must have felt no one wanted him (my opinion not his).

He packed what very little he could into his car, called his lender, told them he was leaving the keys on the counter and he walked away leaving all his life long possessions behind. A totally broken and beaten man.

Fast forward to 2013.

Every month since that day in 2011 Curt says he has kept in touch with his lender. He has given them his addresses as he moves from place to place. His cell phone number WHEN he can afford a pay-as-you-go phone. At some point he was diagnosed as having had "a mental break with severe depression" or what you and I would call a nervous breakdown. He hides from the public, neighbors, friends and family. Shys away from any personal interaction including eye contact. He doesn't want anyone to "see him" hiding behind sun glasses and wishes he was "invisible" doing small painting or carpet cleaning jobs. He's nervous, jumps and flinches at small everyday noises, suffers panic attacks, admits he cries each day and I believe he's now agoraphobic (afraid to go outside). His small cash jobs pay the rent but he still does not receive food stamps or a government subsidy phone. He says he has to retain what little pride he has left.

He's open to the idea of being treated for his depression again but cannot afford it. To hear him tell it, the last clinic he visited estimated his wait time to be 2-4 hours and even then, it would only be an evaluation. He wouldn't receive medication until a subsequent visit. He left the crowded, apparently smelly waiting room after only 20 minutes in a panic. "It doesn't matter" he says, "I couldn't afford meds anyway." Such is the demeanor I feel of many Americans. Deeply forlorn, empty and broken describes him well.

It's been almost two years since he gave up and handed them the keys..........and his lender has yet to foreclose. "What are they waiting for?" he wonders. His death so they can saddle the bill to his children? Indeed what are they waiting for? I wonder as well.

Read More, Comment and Share......

Reprinted from http://mauldineconomics.com

Would the Real Peter and Paul Please Stand Up?

By Dylan Grice

In a previous life as a London-based ‘global strategist’ (I was never sure what that was) I was known as someone who was worried by QE and more generally, about the willingness of our central bankers to play games with something which I didn’t think they fully understand: money. This may be a strange, even presumptuous thing to say. Surely of all people, one thing central bankers understand is money?

They certainly should understand money. They print it, lend it, borrow it, conjure it. They control the price of it... But so what? What should be true is not necessarily what is true, and in the topsy-turvy world of finance and economics, it rarely is. So file the following under “strange but true”: our best and brightest economists have very little understanding of economics. Take the current malaise as prima facie evidence.

Let me illustrate. Of the many elemental flaws in macroeconomic practice is the true observation that the economic variables in which we might be most interested happen to be those which lend themselves least to measurement. Thus, the statistics which we take for granted and band around freely with each other measuring such ostensibly simple concepts as inflation, wealth, capital and debt, in fact involve all sorts of hidden assumptions, short-cuts and qualifications. So many, indeed, as to render reliance on them without respect for their limitations a very dangerous thing to do. As an example, consider the damage caused by banks to themselves and others by mistaking price volatility (measurable) with risk (unmeasurable). Yet faith in false precision seems to us to be one of the many imperfections our species is cursed with.

One such ‘unmeasurable’ increasingly occupying us here at Edelweiss is that upon which all economic activity is based: trust. Trust between individuals, between strangers, between organizations... trust in what people read, and even people’s trust in themselves. Let’s spend a few moments elaborating on this.

First, we must understand the profound importance of exchange. To do this, simply look around you. You might see a computer monitor, a coffee mug, a telephone, a radio, an iPad, a magazine, whatever it is. Now ask yourself how much of that stuff you’d be able to make for yourself. The answer is almost certainly none. So where did it all come from? Strangers, basically. You don’t know them and they don’t know you. In fact virtually none of us know each other. Nevertheless, strangers somehow pooled their skills, their experience and their expertise so as to conceive, design, manufacture and distribute whatever you are looking at right now so that it could be right there right now. And what makes it possible for you to have it? Exchange. To be able to consume the skills of these strangers, you must sell yours. Everyone enters into the same bargain on some level and in fact, the whole economy is nothing more than an anonymous labor exchange. Beholding t he rich tapestry this exchange weaves and its bounty of accumulated capital, prosperity and civilization is a marvelous thing.

But we must also understand that exchange is only possible to the extent that people trust each other: when eating in a restaurant we trust the chef not to put things in our food; when hiring a builder we trust him to build a wall which won’t fall down; when we book a flight we entrust our lives and the lives of our families to complete strangers. Trust is social bonding and societies without it are stalked by social unrest, upheaval or even war. Distrust is a brake on prosperity, because distrust is a brake on exchange.

But now let’s get back to thinking about money, and let’s note also that distrust isn’t the only possible brake on exchange. Money is required for exchange too. Without money we’d be restricted to barter one way or another. So money and trust are intimately connected. Indeed, the English word credit derives from the Latin word credere, which means to trust. Since money facilitates exchange, it facilitates trust and cooperation. So when central banks play the games with money of which they are so fond, we wonder if they realize that they are also playing games with social bonding. Do they realize that by devaluing money they are devaluing society?

To see the how, first understand how monetary policy works. Think about what happens in the very simple example of a central bank’s expanding the monetary base by printing money to buy government bonds.

That by this transaction the government has raised revenue for the government is obvious. The government now has a greater command over the nation’s resources. But it is equally obvious that no one can raise revenue without someone else bearing the cost. To deny it would imply revenues could be raised for free, which would imply that wealth could be created by printing more money. True, some economists, it seems, would have the world believe there to be some validity to such thinking. But for those of us more concerned with correct logical practice, it begs a serious question. Who pays? We know that this monetary policy has redistributed money into the government’s coffers. But from whom has the redistribution been?

The simple answer is that we don’t and can’t know, at least not on an amount per person basis. This is unfortunate and unsatisfactory, but it also happens to be true. Had the extra money come from taxation, everyone would at least know where the burden had fallen and who had decreed it to fall there. True, the upper-rate tax payers might not like having a portion of their wealth redirected towards poorer members of society and they might not agree with it. Some might even feel robbed. But at least they know who the robber is.

When the government raises revenue by selling bonds to the central bank, which has financed its purchases with printed money, no one knows who ultimately pays. In the abstract, we know that current holders of money pay since their cash holdings have been diluted. But the effects are more subtle. To see just how subtle, consider Cantillon’s 18th century analysis of the effects of a sudden increase in gold production:

If the increase of actual money comes from mines of gold or silver... the owner of these mines, the adventurers, the smelters, refiners, and all the other workers will increase their expenditures in proportion to their gains. ... All this increase of expenditures in meat, wine, wool, etc. diminishes of necessity the share of the other inhabitants of the state who do not participate at first in the wealth of the mines in question. The altercations of the market, or the demand for meat, wine, wool, etc. being more intense than usual, will not fail to raise their prices. ... Those then who will suffer from this dearness... will be first of all the landowners, during the term of their leases, then their domestic servants and all the workmen or fixed wage-earners ... All these must diminish their expenditure in proportion to the new consumption.

In Cantillon’s example, the gold mine owners, mine employees, manufacturers of the stuff miners buy and the merchants who trade in it all benefit handsomely. They are closest to the new money and they get to see their real purchasing powers rise.

But as they go out and spend, they bid up the prices of the stuff they purchase to a level which is higher than it would otherwise have been, making that stuff more expensive. For anyone not connected to the mining business (and especially those on fixed incomes: “the landowners, during the term of their leases”), real incomes haven’t risen to keep up with the higher prices. So the increase in the gold supply redistributes money towards those closest to the new money, and away from those furthest away.

Another way to think about this might be to think about Milton Friedman’s idea of dropping new money from a helicopter. He used this example to demonstrate how easy it would theoretically be for a government to create inflation. What he didn’t say was that such a drop would redistribute income in the same way more gold from Cantillon’s mines did, towards those standing underneath the helicopter and away from everyone else.

So now we know we have a slightly better understanding of who pays: whoever is furthest away from the newly created money. And we have a better understanding of how they pay: through a reduction in their own spending power. The problem is that while they will be acutely aware of the reduction in their own spending power, they will be less aware of why their spending power has declined. So if they find groceries becoming more expensive they blame the retailers for raising prices; if they find petrol unaffordable, they blame the oil companies; if they find rents too expensive they blame landlords, and so on. So now we see the mechanism by which debasing money debases trust. The unaware victims of this accidental redistribution don’t know who the enemy is, so they create an enemy.

Keynes was well aware of this insidious dynamic and articulated it beautifully in a 1919 essay:

By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. By this method they not only confiscate, but they confiscate arbitrarily; and, while the process impoverishes many, it actually enriches some.... Those to whom the system brings windfalls... become “profiteers” who are the object of the hatred.... the process of wealth-getting degenerates into a gamble and a lottery.

Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

Deliberately impoverishing one group in society is a bad thing to do. But impoverishing a group in such an opaque, clandestine and underhanded way is worse. It is not only unjust but dangerous and potentially destructive. A clear and transparent fiscal policy which openly redistributes from the rich to the poor can at least be argued on some level to be consistent with ‘social justice.’ Governments can at least claim to be playing Robin Hood. There is no such defense for a monetary driven redistribution towards recipients of the new money and away from everyone else because if the well-off are closest to the money, well, it will have the perverse effect of benefitting them at the expense of the poor.

Take the past few decades. Prior to the 2008 crash, central banks set interest rates according to what their crystal ball told them the future would be like. They were supposed to raise them when they thought the economy was growing too fast and cut them when they thought it was growing too slow. They were supposed to be clever enough to banish the boom-bust cycle, and this was a nice idea. The problem was that it didn’t work. One reason was because central bankers weren’t as clever as they thought. Another was because they had a bias to lower rates during the bad times but not raise them adequately during the good times. On average therefore, credit tended to be too cheap and so the demand for debt was artificially high. Since that new debt was used to buy assets, the prices of assets rose in a series of asset bubbles around the world. And this unprecedented, secular and largely global credit inflation created an illusion of prosperity which was fun for most people while it lasted.

But beneath the surface, the redistributive mechanism upon which monetary policy relies was at work. Like Cantillon’s gold miners, those closest to the new credit (financial institutions and anyone working in finance industry) were the prime beneficiaries. In 2012 the top 50 names on the Forbes list of richest Americans included the fortunes of eleven investors, financiers or hedge fund managers. In 1982 the list had none.

Besides this redistribution of wealth towards the financial sector was a redistribution to those who were already asset-rich. Asset prices were inflated by cheap credit and the assets themselves could be used as collateral for it. The following chart suggests the size of this transfer from poor to rich might have been quite meaningful, with the top 1% of earners taking the biggest a share of the pie since the last great credit inflation, that of the 1920s.

Who paid? Those with no access to credit, those with no assets, or those who bought assets late in the asset inflations and which now nurse the problem balance sheets. They all paid. Worse still, future generations were victims too, since one way or another they’re on the hook for it. So with their crackpot monetary ideas, central banks have been robbing Peter to pay Paul without knowing which one was which. And a problem here is this thing behavioral psychologists call self-attribution bias. It describes how when good things happen to people they think it’s because of something they did, but when bad things happen to them they think it’s because of something someone else did. So although Peter doesn’t know why he’s suddenly poor, he knows it must be someone else’s fault. He also sees that Paul seems to be doing OK. So being human, he makes the obvious connection: it’s all Paul and people like Paul’s fault.

But Paul has a different way of looking at it. Also being human, he assumes he’s doing OK because he’s doing something right. He doesn’t know what the problem is other than Peter’s bad attitude. Needless to say, he resents Peter for his bad attitude. So now Peter and Paul don’t trust each other. And this what happens when you play games with society’s bonding.

When we look around we can’t help feeling something similar is happening. The ïï% blame the 1%; the 1% blame the 47%. In the aftermath of the Eurozone’s own credit bubbles, the Germans blame the Greeks. The Greeks round on the foreigners. The Catalans blame the Castilians. And as 25% of the Italian electorate vote for a professional comedian whose party slogan “vaffa” means roughly “f**k off” (to everything it seems, including the common currency), the Germans are repatriating their gold from New York and Paris. Meanwhile in China, that centrally planned mother of all credit inflations, popular anger is being directed at Japan, and this is before its own credit bubble chapter has fully played out. (The rising risk of war is something we are increasingly worried about...) Of course, everyone blames the bankers (“those to whom the system brings windfalls... become ‘profiteers’ who are the object o f the hatred”).

But what does it mean for the owner of capital? If our thinking is correct, the solution would be less monetary experimentation. Yet we are likely to see more. Bernanke has monetized about a half of the federally guaranteed debt issued since 2009 (see chart below). The incoming Bank of England governor thinks the UK’s problem hasn’t been too much monetary experimentation but too little, and likes the idea of actively targeting nominal GDP. The PM in Tokyo thinks his country’s every ill is a lack of inflation, and his new guy at the Bank of Japan is revving up its printing presses to buy government bonds, corporate bonds and ETFs. China’s shadow banking credit bubble meanwhile continues to inflate…

For all we know there might be another round of illusory prosperity before our worst fears are realized. With any luck, our worst fears never will be. But if the overdose of monetary medicine made us ill, we don’t understand how more of the same medicine will make us better.

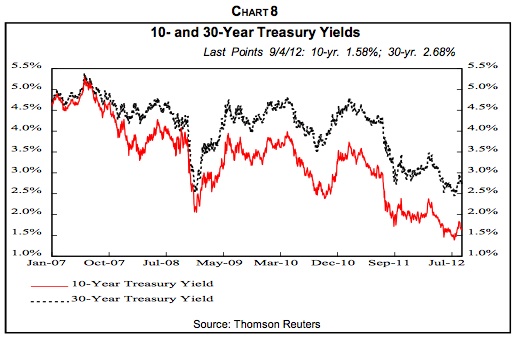

We do know that the financial market analogue to trust is yield. The less trustful lenders are of borrowers, the higher the yield they demand to compensate. But interest rates, or what’s left of them, are at historic lows. In other words, there is a glaring disconnect between the distrust central banks are fostering in the real world and the unprecedented trust lenders are signaling to borrowers in the financial world.

Of course, there is no such thing as “risk-free” in the real world. Holders of UK cash have seen a cumulative real loss of around 10% since the crash of 2008. Holders of US cash haven’t done much better. If we were to hope to find safety by lending to what many consider to be an excellent credit, Microsoft, by buying its bonds, we’d have to lend to them until 2021 to earn a gross return roughly the same as the current rate of US inflation. But then we’d have to pay taxes on the coupons. And we’d have to worry about whether or not the rate of inflation was going to rise meaningfully from here, because the 2021 maturity date is eight years away and eight years is a long time. And then we’d have to worry about where our bonds were held, and whether or not they were being lent out by our custodian. And of course, this would all be before we’d worried about whether Microsoft’s business was likely to remain safe over an eight year horizon.

We are happy to watch others play that game. There are some outstanding businesses and individuals with whom we are happy to invest. In an ideal world we would have neither Peters nor Pauls. In the imperfect one in which we live, we have to settle for trying hard to avoid the Pauls, who we fear mistake entrepreneurial competence for proximity to the money well. But when we find the real thing, the timeless ingenuity of the honest entrepreneurs, the modest craftsmen and craftswomen who humbly seek to improve the lot of their customers through their own enterprise, we find inspiration too, for as investors we try to model our own practice on theirs. It is no secret that our quest is to find scarcity. But the scarce substance we prize above all else is trustworthiness. Aware that we worry too much in a world growing more wary and distrustful, it is here we place an increasing premium, here that we seek refuge from financial folly and here that we expect the next bull market.

Read More, Comment and Share......

For those who found themselves busy fertilizing their lawns and Spring cleaning this weekend, you missed a market-moving decision as Cyprus announced (quite conveniently after Fridays close) an unprecedented levy on all bank deposits of 6.75% for accounts below $100,000 euros, and 9.9% for $100,00 euros and above. OUCH

Adding insult to injury, if you lived in Cyprus and needed cash from an ATM machine, you were out of luck as Cypriots awoke to find bank transfers already frozen as the government prepares to seize the assets when their banks re-open on the 19th although the glimmer of hope exists the final vote tomorrow could fail (there must be a joke there somewhere about PIIGS and flying).

All the talk from EU politicians. All the promises that the Euro would be fine. All of the money printing. All of the haircuts already taken. Blah blah blah blah.......and here we go again.

My hats off to whomever bought the enormous volume in VXX end of Feburary. (click on chart to enlarge) That hedge should payoff nicely on this news. Don't you find it quite coincidental that these Greek news came out AFTER the U.S. released their bank stress tests results? (hehehe)

One would also assume that the reigning Corporate elite and their buddy banksters overseas are having an ever more difficult time squeezing money out of the little guy going forward because simply put, there ain't none left.

Given what the "trickle down" effect did to U.S. assets over the last 30 years, I wouldn't be at all surprised to see the U.S. encounter further resistance from their citizens as well **if** fear isn't contained, and quickly. Needless to say every dog-n-pony show will be out this week to reassure capital markets. After all, OUR U.S. banks passed their stress tests....don't panic..........all is well. (*cough cough* what about their exposure to overseas banks????) Well we've all been waiting for a correction - maybe this'll be the catalyst.

Now I would think the topics of taxing the wealthy, income distribution and wealth inequality have already been to death but thanks to Cyprus, here we go again. *sigh* Oh the pain........

Read More, Comment and Share......

The consumer is alive and well. In fact the consensus for consumer sales was for a paltry 0.6% and it came in at 1.1% with prior revisions being moved up rather than down leaving even Rick Santelli somewhat speechless with nothing to complain over in the details. This proving once again that all the fear mongering about allowing temporary tax breaks to expire and dreaded sequestration cuts would kill the consumer were an outright fallacy. If used to influence votes in Congress and you'd think at some point those men and women would learn how to play the game.

In fact this release could prove to be a game changer from a chartist point of view if the trend continues higher. While some may remain nonbelievers, we have Easter purchasing as well as Spring dead ahead which can do nothing but boost spending further. Bring it!

What a shocker people still need to eat and last time I looked, small children continue to outgrow shoes and clothing requiring new. We all still needed fuel to drive to work. I guess bicycles aren't flying off the showroom floor. I haven't noted any huge increase in sewing machine sales anywhere with the impoverished forced to make their own clothing nor are people flocking to become share croppers that I'm aware of. Certainly consumer discretionary will take it on chin with fewer furniture and auto sales postponed but come on now, you have to admit it's encouraging. To coin an old phrase "a girl's gotta eat" and yes, the consumer clearly still has a pulse.

Read More, Comment and Share......

Today was a typical Saturday. I began to scan my watchlist, ran through the indexes and flipped through my favorite web pages for tidbits of stockmarket insight. At one point I noticed that in wake of yesterdays selloff in gold/silver, suddenly people were posting seasonal charts for gold and silver.....as if they had just been discovered. Helllllo McFly. No, there is no seasonal demand for the shiny stuff here. Hasn't been; move along. Economies are healing; meaning there's less of a need to hedge yourself with gold and bonds. With no demand and less of a flight to safety,the big boys are taking profits. Again, nothing there, move along.

I think some people just stopped paying attention but world economies are less bad, period. While we're not out of the woods, unemployment is stabilizing. Jobs are coming back, albeit slowly and low paying...but things are no longer deteriorating. Maybe the gurus out there just didn't want their subscribers to know the secret to their approach (wink wink). Some struggled attempting to get long the shiny stuff and wait for a pop allthewhile wondering why gold wasn't skyrocketing to $2500 (as some pundits have predicted), we stood aside focusing on better areas to deploy our cash.

You see, we talk about seasonal demand a great deal at StockBuz.net using it to enter quite a few trades throughout the year; and you don't have to trade commodity futures in order to benefit. That's why the trading Gods made ETFs. Utlizing past history, we know what the odds are of success. We know what commodity or sectors are coming into strength and make efforts to position accordingly. Fact is many a trader has cleaned up on seasonal patterns and have penned books on it's usage. Don't get too excited however; it's not the holy grail of investing dear reader. Don't even go there - there is no such thing. At times it doesn't "work" if there's a change in sentiment or trend, over (or under) supply of a certain commodity due to unforeseen circumstances such as drought or worker strike and then there's those pesky, panicky news headlines (Greece is about to fail!); just to name a few. However quite often when market sentiment is right, there exists great reward when technical analysis is telling you otherwise......all because seasonal demand for a commodity (or yes, even a sector) kicks in.

We discussed in November/December that XLF would run for $19.50-20.00; that energy would strengthen, gasoline would run, OIH breakout and small caps to take the lead. They did. We talked about Platinum and industrials. We didn't wait for a guru to post a chart. We have a plethora of seasonal charts at our disposal. We have no "gurus" with subscription fees @ StockBuz; everyone shares their knowledge. We knew the seasonals and 2013 is off to a rip roaring start. Maybe some of you need to brush up on your seasonal knowledge.....or better yet just join us.

Read More, Comment and Share......

Leading up to the market peak, shippers made the fatal error of buying the boom frenzy and ordering the construction of new ships. Once credit markets constricted it was too late for shippers to turn back. By 2009 the dime had been dropped, orders placed, payment promised, they saw a total a total collapse of freight rates; each battling the other for dwindling world wide business (see video)

Many traders believed QE would lift all boats (pun intended) and struggled over and over again to find a bottom in the Baltic Dry Index but to no avail. Wasn't China going to stockpile again? For years we had be "programmed" to that belief. Many simply did not comprehend the impact of world-wide tightening and slowdown, even in China. Voracious demand did not return and oversupply of vessels meant freight rates continued to see pressure even with the Feds money printing as new ships continued to be delivered.

Then finally, a glimmer of hope. Moodys projected that most new ships would be delivered in 2012 or 2013. Market theory began circulating that maybe, just maybe the end was approaching. In the meantime, shippers have been on a long road to healing and that's a good thing........for those names who survive and don't find their way to the OTC graveyard. Record low rates have allowed for credit terms to be renegotiated and M&A may be heating up. NAT recently completed its acquisition of Scandic American and DSX announced a new loan facility, just to name a few. I imagine we'll see much more of the same going forward as global economies heal and business prospects improve. Old vessels continue to be retired/scrapped and with any luck all new deliveries will be completed in due course.

The glimmer of hope may be a lighthouse with prospects of higher shipping rates coming in May; as much as 50% higher in fact which would be a wonderful development.

From a chartist point of view, 2012 may well have been a year of forming a bottom or basing but only time will tell.

$BDI appears to be supported at these lower levels and there has been talk of Asian interests in shipping names. I personally have begun to accumulate NAT as a drawer stock and will continue to accumulate going forward. I will confess quite often I am too early to the party and there remains the chance of more pain to come but if you ask me if shippers are closer to the lighthouse and safe harbors? I for one truly believe so.

Read More, Comment and Share......

You know those moments.......when you were at a family function or out for a few cocktails with friends when someone brought up the topic of the economy or stock market. Those conversations were fairly easy to side step and ensure you'd still be on speaking terms tomorrow. The last five years, however it's an entirely new ballgame and avoidance is not becoming any easier. I think the basic problem for the general public (and many small investors) is that they expected a snap back in jobs in 2-3 years, as is normal after a recession. The problem isn't the current administration. The problem is that we didn't simply experience a recession. We experienced a global financial crisis which is a horse of an entirely different color.

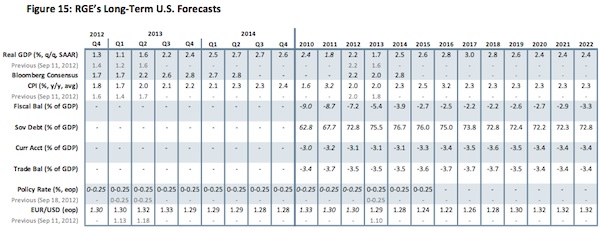

You really can't blame them for not understanding the difference between the two. Most haven't been alive long enough or have knowledge of economic history to realize the ramifications. According to a White House Crisis and Recovery in the World Economy "Although economic dislocations have been severe in one region or another at various times over the past 50 years, never in that time span has the annual output of the entire global economy contracted." The end result boys and girls is not a 2-3 year rebound. The Washington Post warned: housing prices tend to be depressed for years, and credit deleveraging takes about seven years. Additionally, real per capita GDP growth is significantly lower in the decade following a financial crisis. Even today with global central banks easing, the recovery is far from over according to Bloomberg. So where are we truly in the deleveraging process? Roubini Global Economics breaks it down. Enjoy-

By Christian Menegatti and David Nowakowski

Roubini Global Economics

• Question: Are U.S. households done deleveraging? Answer: Getting there; thanks to consumer credit rebounding, household debt increased in Q2 2012, for the first time since 2008, although it dipped again in Q3. Consumer credit held up with a significant acceleration in the pace of releveraging in 2012. Mortgage debt is still shrinking, as homeowners seek to rebuild equity or default.

• Question: Why does it matter? Answer: It matters because deleveraging acts like gravity on economic activity, with repayment of debt sopping up income that would otherwise go into consumption and housing. The good news is that the housing market is looking a bit brighter after five years of residential investment contraction and will provide a significant contribution to GDP growth going forward. However, the welcome housing reflation will be too weak to boost the asset side of household balance sheets and consumption through wealth effects.

• The financial sector is still deleveraging rapidly, partly as securitization markets and government enterprises continue to shrink. Corporations and small businesses are both leveraging up; the former robustly (although nowhere near the pre-2008 pace), the latter anemically. Unfortunately, this borrowing seems to be mainly for refinancing, cash hoarding and equity buybacks, along with some investment in capital stock, but little hiring.

• Question: What does it mean for economic activity and asset classes? Answer: The end of private- sector deleveraging, and, eventually, credit growth increasing to the level of economic growth, will boost U.S. growth closer to its potential rate of 2.5-3.0%. It will allow for slower savings growth, more investment and smaller fiscal deficits. Unlike Japan, which remains in deleveraging mode decades after its bust, the U.S. seems close to ending this painful period of balance-sheet repair, and avoiding the lost decades of ZIRP and dismal equity market returns that come with it.

Here Is How the Story Goes...

RGE’s focus has always been on national balance sheets and the signals of health or sickness that those can send. In this case, the patient is the U.S. economy; the Flow of Funds Accounts of the United States (the Fed Z.1 report) is our quarterly doctor’s visit. U.S. households are very familiar with deleveraging; associated with an economy that will take a long time to return to potential growth and full unemployment. But is the medicine working?

Being in the postcrisis, Minsky-moment aftermath makes us the lucky witnesses of a once-in-a-generation event (one hopes). After over 60 years of almost monotonic growth in the U.S. total debt-to-GDP ratio, the Great Recession unleashed a painful deleveraging process that depressed private demand and pushed policy makers into several rounds of fiscal and monetary stimuli. While fiscal stimulus (a.k.a., releveraging of the public sector to offset the private-sector deleveraging cycle) is now turning into a drag on growth and source of uncertainty, and potentially a heavy one, the Fed has made its open-ended monetary easing stance contingent to labor market performance. Monetary policy can ease financial conditions and can build a bridge to a “better day” (a day in which deleveraging and uncertainty are gone), bu t it is the progress of balance-sheet repair of the household and financial sectors that will actually bring that “better day” a bit closer—the Fed has decided to extend the bridge as long as needed, conditional on inflation (actual and expected) developments.

So, Is Private-Sector Balance-Sheet Repair Over? And Is That ‘Better Day’ on the Horizon?

Pages 8 and 18 of Z.1 tell us that, in Q2 2012, total household credit flows printed a positive number, to the tune of $161 billion, for the first time since Q1 2008 (with the exception of a tiny blip in Q4 2011). That is a far cry from the average quarterly total household credit contraction that we lived with between Q2 2008 and Q1 2012. Unfortunately, Q3 2012 did not repeat the expansion of Q2. With a contraction of $262 billion, Q3 2012 was a bit worse than the average quarterly flow of the last four years. So, almost five years since the official beginning of the Great Recession, how far are U.S. households, in aggregate, into their deleveraging process?

Total Household Credit: Good News and Bad News

Without oversimplifying much, we can break down total household credit into consumer credit and mortgage credit. The good story is in consumer credit; the not so good story in on the mortgage side.

Consumer Credit

Household consumer credit collapsed heavily post-Lehman and relapsed two years later, starting in late 2010, displaying an almost V-shaped recovery (Figure 1). The flow for Q3 2012 ($116 billion) was a bit weaker than in Q2 ($173 billion) but, nevertheless, the trend remains positive and intact.

Source: Federal Reserve

Mortgage Credit

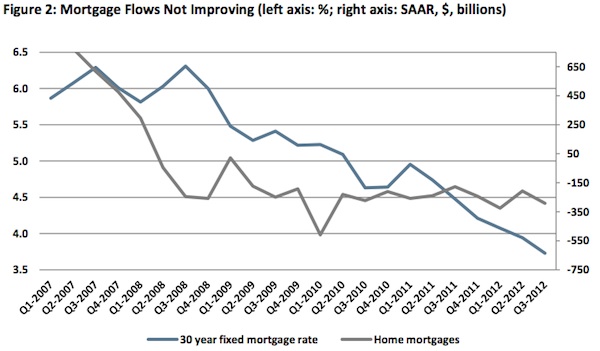

Mortgage flows are still bad news and have been in negative territory since Q2 2008 (Figure 2). The mortgage sector remains stuck in deleveraging mode, even with home affordability at an all-time high. In H1 2012, flows of mortgages obtained by households were as bad as they have ever been since the beginning of this crisis—it does not look like there is much of an improvement there yet. Most likely, this is not just due to the supply side (the broken banking-credit-market channel that the Fed is trying to fix); the demand side is not yet feeling like loading up debt to buy a home.

Source: Federal Reserve and Federal Home Loan Mortgage Group

So, How Are U.S. Households Feeling?

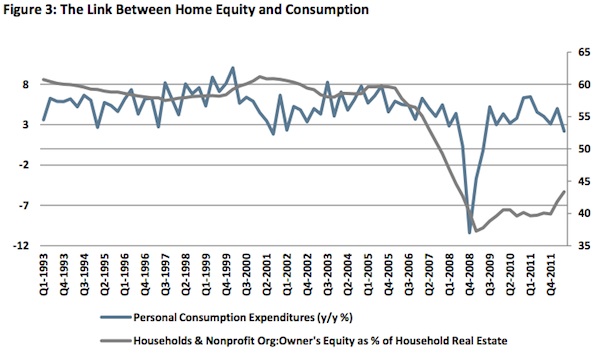

Home equity was allegedly an important driver for consumption (and consumer credit growth) and sentiment (Figure 3). The good news is that home equity as a percentage of household real estate is improving, albeit very slowly, after the collapse of 2007. As homeowners gradually rebuild equity through repayments, and if home prices, after triple-dipping, start to recover in line with inflation, this long-time drag on economic activity could fade within the next year.

Source: Bureau of Economic Analysis and Federal Reserve

Stocks: Housing Matters...

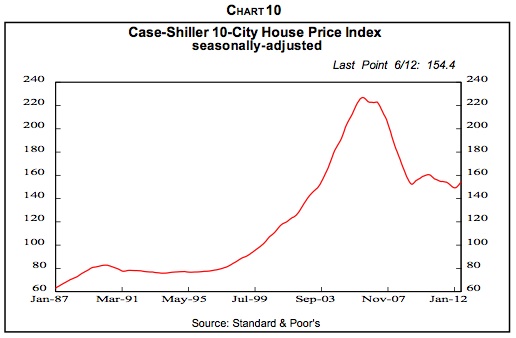

So far, we have only discussed flows. Looking at stocks (levels) gives us a better sense of where we are in the debt/asset journey. Housing is by far the largest single asset on the balance sheet of U.S. households (about $19 trillion out of $78 trillion of total assets). Clearly, U.S. households’ wealth effects and net worth depend a lot on what happens to home prices, where the future for both prices and quantities looks a bit brighter. RGE expects housing starts to grow by a whopping 30% in 2013 and to reach the 1.1 million mark at year-end (annualized rate; housing starts peaked at over 2.2 million in early 2006). Although residential investment is just about 3% of U.S. GDP, and therefore its contribution to growth is limited (about 0.4% in 2013), a housing recovery would have a positive multiplier effect and give a push to housing-related consumption.

The recent trajectory of growth in starts would suggest an even faster pickup. Estimates of housing needs are consistent with starts increasing to well over 1 million, and moving closer to 1.5 million-1.8 million eventually— depending on demand for second homes, capital replacement and household formation, including assumptions on immigration. That number might be a bit high given household formation collapsed during the recession to below 500,000 per year, from the 1.7 million per year in the decade prior to 2007, but a catch-up does need to take place, although some of it may be in rentals (multi-family or commercial real estate) rather than single-family starts.

On the price side, we forecast nominal house price gains of 4.0% in 2013 and 5.2% in 2014. This pace of housing reflation is insufficient to bring significant positive wealth effects; although $1.75 trillion of additional property wealth is nothing to sneeze at, it only makes up for a fraction of the value “lost” in the housing bust. However, the improvement will boost the sentiment of all those households that remain in negative equity, with no income or no income growth and with a high ratio of debt to disposable income that will force them to continue their deleveraging process. And those households might happen to be those with the highest propensity to consume.

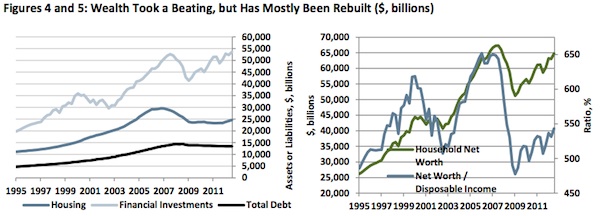

In fact, it is overall wealth, arguably, that needs to be restored to something like its previous level before savings, leverage and consumption patterns are able to return to a more “normal” state. Figures 4 and 5 show that, despite the rebound in equity markets, household net worth in nominal terms is now probably back at its precrisis high of around $67 trillion, but still far off the precrisis trend. On another measure, wealth is at 5.5x income; much improved from 2009, but still only at the levels seen early on in the 1995-2000 “Clinton” and 2003-08 “Bush” recoveries. There is no clear-cut answer as to what wealth ought to be, and demographics and inequality may also play a role. But, after four years of deleveraging, the asset side of the balance sheet seems in good enough shape not to be an obstacle to credit growth. Could something else be holding it back?

Source: Haver, Federal Reserve

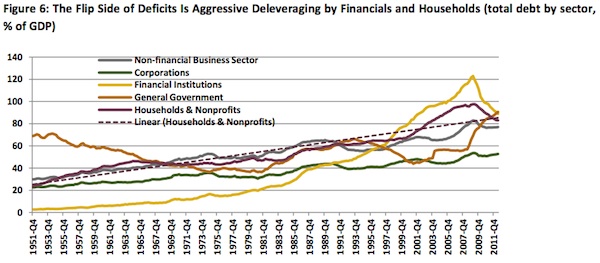

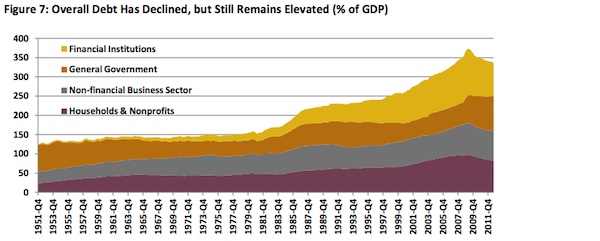

As Figures 6 and 7 indicate, deleveraging on the private side of the economy has been the flip side of the large government deficits. (In fact, the urge to save and the need to default—rather than stimulus—is the main cause of the sustained slump that is in turn the main cause of the reduced revenues and thus the fiscal deficits.) Figure 6 suggests that, compared with the post-World War II trend of rising household indebtedness, the recent debt reduction is already enough. But there is no financial or economic argument for this trend being the right long- term equilibrium. If wealth and income levels are back to mid-1990 levels, and economic uncertainty at 1970-90 levels, then household indebtedness might be more appropriate at 65% of GDP or even 50% of GDP. Even if the current pace of GDP growth combined with defaults and savings continues, it would take until 2016 or 2019 to reach those levels once more.

Source: Haver, Federal Reserve

Source: Haver, Federal Reserve

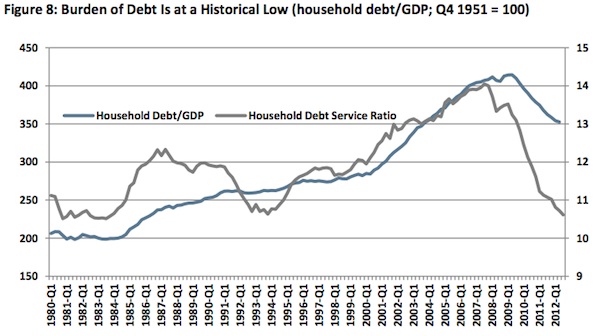

A potential problem with the above estimates (indeed, with using debt/GDP or debt/income at all) is that they compare stocks with flows, and the resulting numbers are not just percentages, but should be given the correct units, which are “years.” There is no reference to the cost of the debt, its maturity, assets or growth of GDP.

One additional and useful measure would be the amount needed to service the debt. The Fed measures this by dividing the estimated payments on debt (inc. principal; e.g., minimum payments on credit cards and mortgage amortizations) by disposable personal income. In this way, longer maturities and lower real interest rates are better captured—and the result looks dramatically different, as shown in Figure 8. At 10.6% of income, the actual burden of debt is as low as it was in the early 1980s and early 1990s, after recessions and rate cuts. The broader measure, which includes auto lease payments, rent, homeowner’s insurance and property tax, is likewise near its historical troughs (below 16% of income, down from 19% in 2007). Although there was not the dramatic net deleveraging the U.S. is experiencing now, after a period of 4 years in the first case and 2.5 years in the latter, robust growth and leveraging were ready to begin again, and even tolerate aggres sive hiking cycles. However, in the early 1980s and 1990s, inflation (and nominal GDP) was running at over 10% and 6%, respectively—that has not been the case during this deleveraging episode.

Source: Household Debt Service and Financial Obligations Ratios and U.S. Flow of Funds reports, Federal Reserve

Enter the Fed

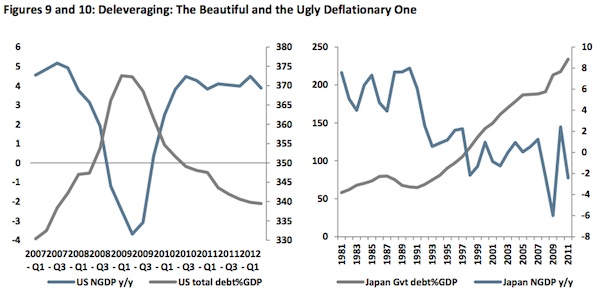

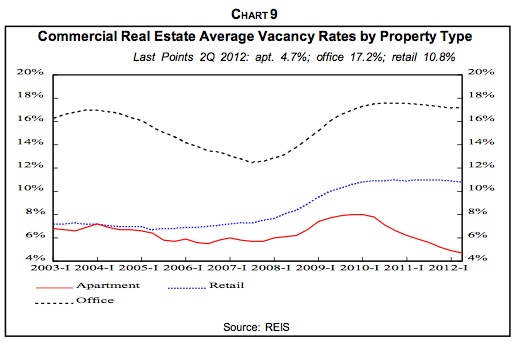

The Fed is determined to push on a string until a significant improvement in labor-market conditions comes about. This will help nominal growth (rather than real), which seems to be the goal/target at this point (and not just for the Fed)—and also hopefully the achievement of an even more beautiful deleveraging..., comparing and contrasting with that of Japan for example (Figures 9 and 10).

Source: Bureau of Economic Analysis, U.S. Treasury, Bank of Japan and Cabinet Office of Japan

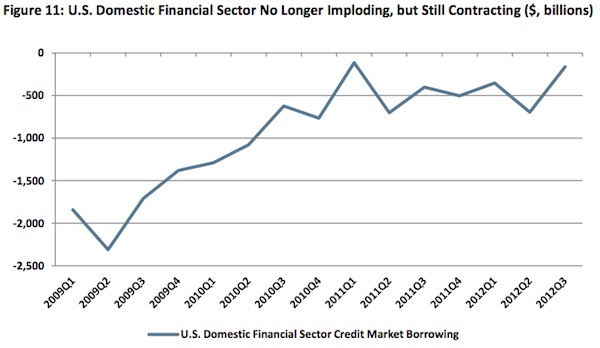

QE3 will help prompt another wave of refinancing, but will it unlock the credit channel? The other not so good news on page 8 of the Fed’s Z.1 report is that the domestic financial sector is still in deleveraging mode (Figure 11).

Source: U.S. Flow of Funds, Federal Reserve

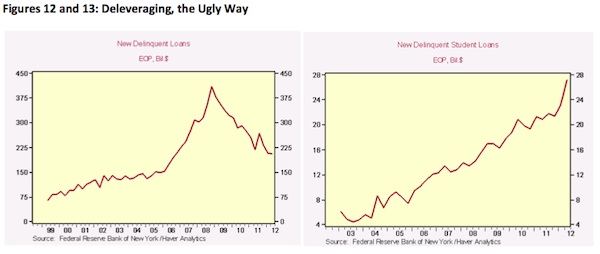

It is important to remember that deleveraging is a vague term, if not a euphemism. Although it can take place through the saving and repayment of debt, it is also possible through other processes: Namely, default and inflation/growth. While nominal GDP growth is anemic, time is an important factor in the healing process. Defaults, on the other hand, are quick, but painful. And there has been plenty of pain to go around, but it is largely abating (Figures 12 and 13). In particular, after the spurt of subprime and Alt-A defaults that were inevitable, the bottoming out of housing, the belated and poorly implemented HARP programs and the weak recovery have stabilized mortgage defaults and foreclosures. If there is one sector to be worried about, it is student loans. Although these loans are largely a federal exposure and total a mere $ 1 trillion (and so unlikely to trigger a systemic financial explosion), the sector is now bigger than auto loans or credit card debt, and is likely to be a dual burden on the current crop of college graduates, together with joblessness and underemployment.

Source: Federal Reserve Bank of NY, Haver

Conclusion

From a balance-sheet perspective, the U.S. household sector is coming to the end of its period of deleveraging that began in 2008. Wealth has been rebuilt (Figures 4 and 5), debt has been cut through defaults and repayment, and incomes have recovered (Figure 14 shows the detailed decomposition of this process). As long as interest rates remain low, and deflation is avoided, a more normal period may soon begin, although debt levels in some sectors remain high. As households join corporates in borrowing (at a rate, one hopes, more in line with incomes and demographics), consumption and investment (residential and capital) will support a rate of GDP growth that will gradually return to the potential level, even as the baton is passed from government income support and generous tax cuts. But important questions to keep in mind, which we will address in forthcoming analysis, include the following:

• What will happen to real wages, disposable income growth and savings?

• Will the mini releveraging cycle, helped by low real rates and painstaking repayment, be killed off by the fiscal adjustment in the U.S. (even if the austerity is not as severe as it might have been under a full “cliff” scenario)?

• Will recession/slowdown in the eurozone and China damage corporates and banks via financial conditions and sentiment, or hurt household balance sheets via the equity markets?

• And even if assuming that deleveraging in the private sector is over in aggregate and across different types of liabilities, what will credit growth look like in the U.S. in the near future, and to what levels will leverage converge in the medium term... and what would that mean for growth?

Source: RGE

Source: RGE, Bloomberg, Federal Reserve Bank of St. Louis FRED

Reprinted with authorization from John Mauldin Outside The Box http://mauldineconomics.com

Read More, Comment and Share......

Growing up on the South side of Chicago, you learned two lessons at an early age. If it was Sunday afternoon you didn't walk in front of the (tiny black & white) television screen and you never, ever tried to change the channel if the Bears were playing.........not if you were partial to keeping your arm. Sunday afternoons were a time of pigskin worship and the Superbowl.....the ultimate homage. Those were our idols. Our supermen. Plowing through linemen in December slush with chunks of turf in their face mask; there was no greater glory. Just how much longer this sport remains as it is, I'm beginning to worry.

I don't say this because of the sky high regular season tickets prices with an average of $144 a piece; sufficient to feed a family of four for a week. It's not because it's falling in popularity. In fact according to a Harris poll, in 2012 football became the #1 most popular sport in the U.S. surpassing America's past time, baseball. In fact betting on NFL games is now more popular in the U.S. than college football or baseball; a stat I never thought I'd see given it's short season and limited number of teams.

It is because greed saw an area to exploit; to drive higher and higher at a much faster pace than income levels. Then the credit crisis hit but prices continued to soar and like all bubbles, it will eventually pop. Fast approaching are the days when only the upper crust will be able to afford to take the kiddies to the fame. Who will fill the stands?

Then there's belt tightening to improve the bottom line. Bear fans still haven't gotten over losing their beloved Honey Bears and five other teams have followed suit but there's more to come. It's no small wonder how the weakening of unions over the last 60 years didn't hurt the fall of manufacturing jobs. The same pressure applied to the UAW and other unions to renegotiate or fear franchise collapse (cough cough) will increase in intensity and scope. Give away negotiate revised pay levels will be pushed even harder with fewer benefits for the players. Some experienced pros will begin to retire early; their nest eggs being made. What will be left........I leave to your imagination.

In the mean time the league's pocketbook will continue to bleed as it has seen lawsuits double in recent years and there doesn't seem to be any end to the trend ahead soon. Just last year 2,000 ex-players filed a suit regarding head injuries and Junior Seau's family filed suit once he committed suicide after being diagnosed with CTE, a brain disease linked to blows to the head which can result in depression and dementia.

Let's not forget, the players themselves are changing. It seems not a week goes by we don't see a new name splattered across a tabloid headline like a bad nightmare. This isn't your Fathers NFL and the idols seem few and far between; let's just leave it at that.

Lastly America itself is changing to a Honey-Boo-Boo, "setmeupwitharichguy" and gold-digger-baby-daddy reality show nightmare so what's the future of the NFL? I say just throw a couple of fund managers into the Octagon, turn the lights off and go home. How much worse can it get?

Read More, Comment and Share......

Hi there! This a friendly reminder that your StockBuz profile is somewhat *naked* and requires an Avatar.

Come on now.....it only takes 2 minutes to show your style and let the community see what you're all about.

Simply log into http://stockbuz.net

On the top bar, click on Settings.

Click on "Browse" to upload.

Be certain to "Save" at the bottom of the page when done

While you visit, be sure to check out the new sections in our Home page. Options, Macro, Forex and more. We're here to stylize the site to fit your needs. Have a blog or website which you frequent each week? Let us know @ stockbuzsupport@aol.com

We're also encouraging you to let your voice be heard! You don't have to be a Nobel prize winning journalist to have an opinion, a view on the market or investing in general. What steps have you taken to improve your investing? What books, seminars, etc. have had the biggest impact on you and why? What do you believe would reassure Mom & Pop to re-enter the market or are they out for good? Are the Feds actions a help or a hinderance? Have an opinion on the next big bubble? Let us hear it. Post a blog today and be featured in our next newsletter.

We're enjoying some unseasonal warmth here in Texas and I plan on taking full advantage. Hope you enjoy your weekend. I look forward to your new avatar.......come visit us in Chat.

-Kos

Read More, Comment and Share......

Growing in popularity, price matching has become the norm however I see it truly mutating and it's only going to get worse [for margins] if you ask me.

Times were when clipping coupons in the Sunday paper saved you a buck or two with some retailers offering double coupon days and Senior discount days [generally the day before the new ad was to be released] in order to clear old merchandise off the shelf. For those of us struggling to budget with small children, double coupon days at Venture and Zayres was a boon and if there was a Blue Light Special on ham at Kmart, we were there. That was the 70's and inflation was taking a bite out of our pocket.

Evolution slowly lead to price matching between retailers *if* you had a valid ad in hand and your checker called over the Manager for approval who would scrutinize every detail, glasses pulled down to the tip of his nose. This alone guaranteed you a good 5-10 minute wait [mininum], usually with a runny-nosed whining child, impatient at your heels but if you were price matching Fisher Price toys, it was well worth the wait. If a woman ahead of you was price matching, you rolled your eyes and beat feet for another lane. That was the 80s/90s. Jobs were plentiful and the economy was booming.

Fast forward to the 21st century and the post-credit crisis economy and general merchandisers are struggling. Names such as JCPenney have struggled to adapt to the changing consumer and compete with discounters. Target has rushed to compete with the Walmarts and Dollar Generals of the world, scrambling to revamp their store space with groceries and one almost can hear the return of Kmart's Blue Light Special off in the distance as they [and other general merchandisers] struggle to draw in the consumer.

Today numerous grocers:

- Double coupon values on a daily basis [up to a certain value].

- They will also accept more than one coupon on a purchase [many up to four coupons per item].

- Allow coupons to be combined [store coupon + manufacturers coupon].

Websites for "couponers" such as Coupons.com and CouponDivas have grown with lightening speed alerting members to free offers, tutorials on how to become an extreme couponer as well as manufacturer coupons and rebates. There are "coupon installers" online and women have become quite proficient printing multiple coupons and cutting major corners. There are pages on Facebook for couponers and classes offered everywhere where women can learn how to "get it for free".

Even my own daughter has become a crazy couponer posting this on her FB page "I got all of these for free!". Yes, it's viral and it's not going away.

I noticed that back from the dead this year were layaway programs and I'm curious to see how well they fared. Wouldn't be a bit surprised to see this expand further at other retailers as long as growth [and paychecks] remain low.

For certain, the new norm is virtual savings and online coupons which download to a shoppers "smart card" dangling on our key chains with retailers tracking purchases and tracking buying trends. Gasoline savings based on dollars spent at Meijer, Tom Thumb and others, never seen by previous generations. Restaurants have increased their discounting efforts offering buy one-get one free meals. The savings frenzy continues to expand, all to entice to the consumer to keep spending.

It's now commonplace to see women with a handful of ads in the checkout at Walmart price matching anything from chicken to diapers to sneakers. They've evolved with the changing consumers pocketbook and strive to be your one-stop shopping place.

Today Target announced it will now price match online retailers such as Walmart and BestBuy in an effort to be a one-place shop and keep you in the store. Certainly all others will quickly fall in step but what will this mean for margins? Clearly they're adapting to the new, underemployed consumer but I have to wonder how far the rubberband can stretch?

Raise your smart phone, snap a pic and price match your next car. Liquor store price matching online Stoli? Outstanding. Need some bridgework? Your Dentist will match online pricing. Better yet, price match medical services and prescriptions? Bring it.

The overall message is some will adapt and survive in this low growth environment as the world continues to de-leverage and consumers struggle with low paying wages........and others will not. I seriously believe it's going to become more difficult for many retailers margins before it improves. Only one thing is for certain; announce 4x chip days at the casino and I'm there and I'm bringing friends.

Read More, Comment and Share......

A long standing theory of reversals for Technical Analysts, buy [or sell] a break of a third trend line has been around for ages. Also considered by some as the Fan Principle, it allows you to wait for supply and demand to battle it out and jump in when the winner [trend reversal] finally reveals itself.........not to mention with a nice base for support [or resistance].

Very often a consolidation within a trend is considered a "resting period" before another leg down [or up] continues but how can one tell if the trend is truly over? That's when a break of a 3rd trend line comes in handy.

It worked quite well when the U.S. Dollar reversed.

I also utilized the method getting long WLT @ $29.60 [just to name a few]

Now I've been stalking bonds to the short side along with every other market participant after having been long TLT in the Spring of 2011 [now flat] but this chart of TBT has truly piqued my curiosity.

I'll be waiting and watching for a 3rd trend line break and I guarantee you I won't be the only one. *If* TBT remains in its recent range, it will approach it's third trend line juuuust as we will approach the debt ceiling/fiscal cliff extension expiration in a few months. Truly something that makes me go "hmmmmmmmmm"

[Click on chart to enlarge]

Read More, Comment and Share......

Are you a news addict? A market junkie? Are you fully functional to walk away or are you hooked? Do you need the fix on your television every day? Can you make it through the trading day without the bias and noise? Just grab the morning's econ numbers and step away; cold turkey? I triple-dog dare you.

Ignore the plethora of pontificating pundits [or as I call them *smidiots*] chanting that the market is cheap. The CEO's cheerleading for their own product; always painting a rosey future picture [even if they have to change that forecast down the road]. Seriously? Can you say bias? Turn off the clowns whose job is to entertain you as they "educate" and convince you to "buy buy buy!". The *anal*ysts playing tug-o-war, "my way is better" over sectors; each with his own belief system of valuation. P/E is the way to go. No, it's price to cash flow, tangible-book-value, forward earnings vs. TTM [trailing twelve month for you newbies] or whatever justification they can find to convince you and every other viewer just what to do with your hard earned savings and 401k........buy.

THAT is their JOB.......not only keep you informed, but to entertain, keep you in the loop, motivated and energized. You know you need to do something with your money and why would anyone on a syndicated television program lie? You're subconsciously seeking approval. The big "o.k." and you're not alone. Humans have the natural tendency to seek out information that confirms their preconceptions, independently of whether they are true. Confirmation Bias is, after all, a wonderful thing.......or is it? It gives one the illusion of being in control, knowing [or believing in knowing] what's to come.

Traders also have a tendency to follow others trade tweets and blog recommendations. If you've ever played Roulette and watched others place bets on the same numbers as a *hot winner* at the table, that behavior is considered Illusion of Control by Proxy. Believing his knowledge of the game, odds or luck must be superior to yours......so you follow him.

It seems natural that when actively trading, one watches CNBC, Fox Business and Bloomberg for guidance, reassurance.. They, after all, have far more knowledge and insight into the market than you [or me] in what lies ahead. Even if they made mistakes in the past a la Cramer's "Bear Stearns is fine" call, Meredith Whitney's 2010 warning on Muni bonds or Doug Kass's 2010 short bonds call, we give them a mulligan and continue to watch the hype. As we hear news [bad or good], our confirmation bias takes over and we scan the news and blogs as we seek out those who we believe are more informed and/or more experienced. Who we trust.

The bias is the same if you have a negative outlook. Consider: when it comes to Mr. Market, for every buyer there is someone selling. For every analyst on your screen saying your stock [or the overall market for that matter] is sure to head higher, there is another analyst who can justify the opposite. Another ZeroHedge, Dshort or Marc [Dr. Doom] Faber who pounds the table, screaming the market is going to implode [at least that's how it seems]. They appear consumed with attitude polarization for whatever reason and will never be happy no matter what the econ. news. Every headline is fraught with internal weaknesses confirming their negative view.

Somewhere in between there must lie a happy medium.

What would happen if you *didn't* watch them throughout the day? Will the world end? Market implode? Volumes dry up and the stock market as we know it, come to an end; crashing to zero? Will news television cease to exist? Certainly not. The sun will rise tomorrow and money will continue to flow. One thing you will notice.........is your trading improves. Tuning out news television forces you to sit on your hands and look past the glitz and flashing lights, truly focus and invest based on fundamentals, the larger macroeconomic picture and what the charts are telling you.......yes just like the big players.

Maybe, just maybe, it forces you to invest based on your own convictions, your own beliefs. Not based on today's option flow. Not based on a CEO attempting to reassure nervous investors to retain his market capital. Not based on a smidiot who, quite frankly, could care less if he's wrong tomorrow and you lose $500. He's made his millions. He has his contract and a steady job. He tried but he guessed wrong. Oops. All he has to do it appear contrite next week and he'll get another mulligan once again.

Confirmation bias however comes with it's own risks. Anyone remember Lenny Dykstra? Lenny, or Nails [his nickname], was a former Major League Baseball player for the 1986 World Champions, NY Mets and the 1993 National League Champions, Philadelphia Phillies who was called "one of the great ones in this business" by experienced ex-hedge fund Manager Jim Cramer. He was so good, he convinced veteran Wall Streeters he knew his stuff with options strategies so complex that veteran reporters were left confused. So good, he was a guest on CNBC [you mean not all guests are credible?], issued his own newsletter "Nails On the Numbers" and was granted a premium service on theStreet.com with an enormous following, only to go down in flames charged with fraud, theft and more. While some will say Lenny was an anomaly in the business, my point is that thousands every day tune into news television, Twitter and the web for confirmation, guidance and insight. Thousands every day who are watching no more than a dog and pony show............[you're not going to like this] instead of using their brain.

I'm the first to admit that after 25 years in mortgage banking and self-directing my investments, there was still an enormous learning curve when it came to actual trading for myself. Beginning in 2001 wasn't the kindest of all periods during which to make the plunge however it taught me a great deal:

- Don't believe everything you see or hear on television. Some guys were still fighting the trend in 2003 long after the dot.com bubble had burst and 40% of SPX market capitalization had evaporate.

- Learn your moving averages; especially those on longer time frames. Big money buys at 50month, 100month, 150month, etc. levels. Why aren't you?

- Be extremely skeptical of any bearish charts you're given which only reflect a 3-5 year history and patterns. You'll see tops and they'll scream doom and gloom when in actuality, going back over historical charts you'll see the identical patterns over and over and over again and guess what? The market survived! In my mind, any chartist that urges you to invest this way, should be removed from your *trusted* list. Go ahead and read if you wish but make darn certain you're not investing your capital based on "theory" and speculation. Let the charts show you the way.

- Bubbles come to an end.

- Every momentum move eventually loses steam and the market *shifts* in a new direction; seeks out new leadership.

- No one knows it all. There is no "holy grail" of trading. After all if someone has the holy grail, why does he need to sell it to you for $499 with no guaranty?

I've been through the lies, the clowns, the *anal*ysts who were right and wrong. The twitter names who faded into the sunset and others who went subscription only. I had margin calls some mornings and woke up with enormous winners others. I made it through two huge downturns which many weren't so fortunate. I was happy program trading, swing trading and doing my own *thang* but then a fellow trader [yes Ryan Romero, that'd be you] urged me to cut out news television and see the difference.

Once I did [turning it off or muting after the morning's econ news releases were over], things changed dramatically for the better. Before I hit any button, I made certain I wasn't lieing to myself [even if it was against what the pundits were saying], talking myself into a bad trade with high risk. It was no longer trading on emotion because I *might miss out* as the tv *anal*ysts implied. It was trading based on technical levels with a longer hold period and less fees [sorry Mr. broker but my commissions are far less than year - no Pointsetta for me]. As a shameless plug I must also give credit to my fellow StockBuz members as they too, are wonderful at voicing concerns when they thought I was wrong, looking out for one another in seeking he *good* trades and collaborating on just where are the best levels to buy. They do a great job of knocking that little devil on my shoulder saying *buy buy buy!*.......right on to the floor. We've hit some outstanding moves these last few years; not just in momentum stocks but in TLT, UNG [yes!], BRK.B, WAG, the top in Copper, Silver and Gold, ANF, DECK and many, many more. I cannot say enough about the camaraderie and open sharing platform all for a FREE membership. Thank you guys/gals for always having my back.

We luckily also have the internet, with tens of thousands of websites to research with which we can learn, expand our knowledge base and ultimately come to our own conclusions on market direction. News television is no longer the end-all-be-all when it comes to investing and if you feel that it is, Sir you shouldn't be trading.

Getting back to the main subject somewhere, I think the reason I love the market is because you never stop learning. The market is a journey with endless new horizons. Always changing, always shifting, always evolving. It's not that pundits on news television aren't providing a service; they are and for the most part they do their best. It's also not that they should be expected to be 100% correct all of the time but one has to understand that they have a motivation or bias for keeping you glued to the set. It's called job security and they've got a hot winner guaranteed not to lose right after the sponsor-paid-for commercial break.

Read More, Comment and Share......

A discussion in Chat the other day prompted me to pull out some charts to demonstrate visually the points being covered. On this topic Ryan and I agree. Specifically, that seeing a double high in price just isn't enough in our book to call something a double top with any form of confidence when risking my money. Rather I would prefer to see some form of negative divergence in indicators to lead me to believe that the trend is weakening and ready for a reversal.

Now the learned gentlemen @ FreeStockCharts.com lay out some great guidelines in their Chart School on double tops:

- You have to have a prior trend to reverse.

- Volume increase on the breakdown [as they clear out stops] is helpful to confirm.

- Time. I'm also in agreement with them that I prefer to see one to three months elapse in the building of the two peaks. Remember, big money is placing their buy/sell orders based on weekly and daily timeframes. That's not to say that these conditions cannot exist intraday [5/15/60min], but the longer timeframe [daily/weekly] rules the trend of the stock so don't fight the trend.

The thing they don't address and I definitely like to see is negative divergence in MACD, Stoch or some other indicator when the 2nd peak is achieved as a confirmation of weakness in a stock

As an example, MSCC challenged it's high but you'll notice that MACD failed to achieve a new high. That's a negative divergence and it's that divergence that leads me to believe that buying interest in the stock has waned. Warning Will Robinson.......stay away!