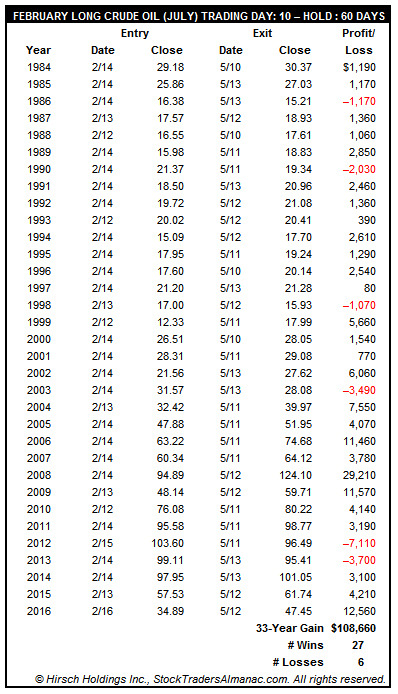

Crude oil has a tendency to bottom in mid-February and then rally through July with the bulk of the seasonal move ending in late April or early May. It is that early February low that can give traders an edge by buying ahead of a seasonally strong period. Going long crude oil’s July contract on or about February 14 and holding for approximately 60 days has been a profitable trade 27 times in 33 years, including the last three years straight, for an 81.8% win ratio with a cumulative profit of $108,660 (based upon trading a single crude oil futures contract excluding commissions and taxes).

Crude oil’s seasonal tendency to move higher in this time period is partly due to continuing demand for heating oil and diesel fuel in the northern states and partly due to the shutdown of refinery operations in order to switch production facilities from producing heating oil to reformulated unleaded gasoline in anticipation of heavy demand for the upcoming summer driving season. This has refiners b