It appears they have the votes. Market is responding.

Read More, Comment and Share......

It appears they have the votes. Market is responding.

Read More, Comment and Share......

Rules and regulations exist to let us know what behaviors we should expect from the people we do business with. Sometimes, good sense or social convention overtake these rules — and they don’t matter so much. Just about everyone wears seat-belts these days (we all know how much they improve our odds of survival in an accident); the ranks of underage smokers have plummeted (it’s no longer cool). Once the toothpaste is out of the tube, as they say, there’s no cramming it back in.

Such is the case with the Department of Labor’s fiduciary rule. On Friday, President Trump asked the Labor Department to review the rule, which requires brokers working with retirement savers to put the interest of their clients ahead of their own. After years of work on it, the regulation was finalized last year by the Obama administration.

At first blush, this looks like a big way the Trump administration could directly affect everyday investors. As it turns out, whether the fidicuary rule hurts you isn’t up

Read More, Comment and Share......

We are into the homestretch of 2016, and the markets have seen strong upside this year, benefiting from the domestic economy's resilience and the election of Donald Trump.

We are into the homestretch of 2016, and the markets have seen strong upside this year, benefiting from the domestic economy's resilience and the election of Donald Trump.

With just four sessions to go, the Dow Jones Industrial Average has been a up a solid 14.4 percent, the S&P 500 has risen 10.8 percent and the NASDAQ Composite is 9.1 percent higher — with all the three major averages trading off their all-time closing highs.

Among the ten S&P sectors, eight have been in the green. Old economy stocks such as energy, material, industrial, financial, utility and telecom are all up by double-digit percentages. Technology stocks are also up decently. However, the healthcare sector has taken a hit.

Though it is tough to replicate the performance of 2016, given the tougher comparisons and the uncertainty around policies amid the political leadership transition, Wall Street does see some opportunities that are compelling.

Here is a compilation of some top picks recommended by Wall Street an

Read More, Comment and Share......

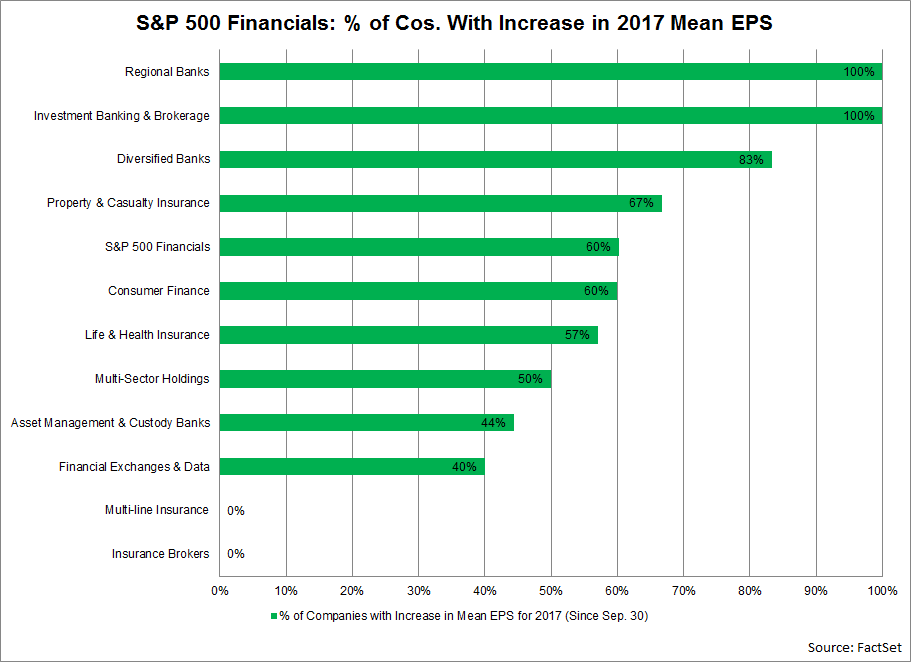

The S&P 500 Financials sector has been a focus sector for the markets in recent weeks. This past week, the Federal Reserve Board increased the target range for the federal funds rate. Earnings for banks and other companies in the Financials sector are particularly sensitive to higher interest rates. In addition, this sector has recorded the largest increase in value (+22.2%) of all 11 sectors in the S&P 500 since the start of the fourth quarter (September 30). Given these developments, have analysts been increasing their 2017 EPS estimates for banks and other companies in the S&P 500 Financials sector over the past few months?

The answer is yes. In terms of EPS estimate revisions, 38 of the 63 companies (60%) in the S&P 500 Financials sector have seen an increase in their mean EPS estimate for 2017 since September 30. At the sub-industry level, the three subindustries that have the largest percentages of companies that have recorded an increase in their mean EPS estimate for 2017 (sin

Read More, Comment and Share......

As U.K.-based banks wait to see what life will be like after Brexit, one word -- passporting -- will speak volumes. If Prime Minister Theresa May can maintain the passporting rights of City of London banks, the U.K. stands to retain its status as a hub of global finance. If not, hope isn’t lost, but the alternative to passporting requires an arduous approval process and provides no secure basis for long-term planning.

Passporting refers to the right of companies authorized in one country of the European Economic Area -- currently comprising the 28 EU states plus Iceland, Liechtenstein and Norway -- to sell their products and services throughout the bloc, accessing a $19 trillion integrated economy with more than 500 million citizens. There is not one financial passport, but rather a series of sector-specific agreements covering everything from banking to insurance and asset management. It’s why global firms such as Goldman Sachs or Morgan Stanley

Read More, Comment and Share......

In addition to charts I uploaded (which there are many more but I'm short on time, it being a holiday) here are a few of my weekend email reads I found interesting. Enjoy - and Happy Easter.

Read More, Comment and Share......

"A few outsiders saw what no one else could". Hat tip to sadiq. With so many big stars, I'll be watching this one.

Read More, Comment and Share......

Ready for tomorrow's numbers, gold and IWM are ready to head either way. Utilities are sitting at support and banks are ready to scream up.

Higher-than-expected claim numbers will mean the economy is not as strong as we believed and the chances of a June rate hike will be off the table until September.

No support or resistance is broken so we'll wait for the numbers but isn't it grand; how the markets are not rigged. Sarcasm alert there. Good luck.

Read More, Comment and Share......

Who doesn't love the lame duck session? It's that special time of year when Santa comes early to Wall Street and you too, can benefit. As one example, outgoing Congressmen and woman who lost during mid terms, tend to throw in the towel (they won't be around next session anyway) and all types of goodies get through the Congressional pipeline which were stalled during the normal session. This years winners if you're an investor are:

Who doesn't love the lame duck session? It's that special time of year when Santa comes early to Wall Street and you too, can benefit. As one example, outgoing Congressmen and woman who lost during mid terms, tend to throw in the towel (they won't be around next session anyway) and all types of goodies get through the Congressional pipeline which were stalled during the normal session. This years winners if you're an investor are:

Read More, Comment and Share......

While the market continues to digest yesterdays' comments from new Fed Chairwoman Janice Yellen that rates will begin to rise possibly as early as six months after tapering is complete (mid-2015 rather than late 2015), banks are definitely yelling pahtay with big gains across the financial sector today.

Even $C (who I normally detest) is attempting to breakout of a beautiful double bottom pattern.

Like it or not, banks will be more willing to lend in a rising rate environment and let's face it; it's tough to make a buck when you're lending at 3%. I would imagine this will be good for broker/dealers as well although not shown here. Now if only we could get Congress to do away with that pesky transaction tax debate. Life would be wonderful.

Full disclosure; I'm long JPM and loving today's action.

Read More, Comment and Share......

I gleaned this from a twitter mention and after searching a bit, I found it in pdf form. Ironic, I found it on a blog resource I sometimes frequent. It is dry reading, but it is full of useful information.

Read More, Comment and Share......

If they were to pursue foreclosures in a timely fashion as well as push out the REO's sitting on the books, prices would fall. Don't believe for a minute this is only the U.S. either. This is/will be a global approach. Now that values in many areas are almost back to pre-crisis levels, are we about to see a glut of inventory hit the market? I'm willing to say so. House hunting anyone? (RealEstateEconomyWatch)

Read More, Comment and Share......

Meet "Curt" who, as credit lines worldwide were tightening, lost his middle management job in finance in 2006. Of course Curt had no idea of what was to come. He was a good worker, great work and credit history and was lucky to have a nice nest egg saved up. He wouldn't need unemployment, no. He'd have a job in no time so he did what every good American in his position would do. He dusted off his resume, began to network/emailing his resume and paid his bills using his hard earned savings and waited.......for a job that would never come.

Then bubble burst. The market began it's long downwards spiral but Curt, undaunted, continued emailing and living off of his savings....and still did not file for unemployment. Surely something will turn up any day now, he told himself.

For four years.

Four years of bank failures, branch closings, massive consolidations and layoffs.

By 2010 the stock market was clearly rebounding however it was all over for Curt. After four long years he ha

Read More, Comment and Share......

Read More, Comment and Share......

You can't use this site and its products or services without agreeing to the terms and conditions and privacy policy.

We welcome you to post a blog entry, oped or share your daily reading with us as long as it is relevant to the topic of investing and not an attempt to sell a product, proprietary strategy, platform or other service. Please provide links to any research data and if re-posting other articles, give credit where credit is due providing a back link to the original site.

300 words minimum per post. You may also sort by category or search by topic. Don't forget to comment and please "share" via Facebook, Twitter and Google+. If you have any questions, please contact us.

__________________