Presented without commentary other than ask yourself, "how much longer?"

Read More, Comment and Share......

Presented without commentary other than ask yourself, "how much longer?"

Read More, Comment and Share......

With crowd source funding, your arm may become the next place to locate directions via GPS with a pico projector or the way you stay in touch with social media........without ever touching your phone. Up for a donation; get a discount. Imagine the possibilities.

Courtesy of Cicret Project

Read More, Comment and Share......

A reader asked the other day, "How much time do you need before you can separate skill versus luck in investing?"

My answer was "probably 20-30 years," which he found astounding. He thought I'd say five years. But here's my reasoning.

If a doctor performed one successful surgery, you can be pretty sure he's an expert. If he does one successful surgery every day for a year, he clearly knows what he's doing.

Investing is different. There are thousands of stocks, and at any given time, a fair number of them will be exploding higher. With millions of investors, some will be holding disproportionate amounts of those winners at any given moment. It can take five or 10 years of successful returns for an investor to make a case that results aren't entirely due to chance.

But even then -- with, say a 10-year track record of success -- an investor can't claim expertise. Or at least reliable expertise you'd expect from a doctor or an engineer. That's because the world is always changing, and th

Read More, Comment and Share......

There once was a series of interviews with Jim Cramer, as you'll see here where he talks about his days as a Hedge Fund Manager, and they were a wonder to behold. It seems many have been 'scrubbed' from the web (nice job Jim) but I came across this one and it'll give you a glimpse into the games that are played behind the scenes. CNBC and its cohorts are entertainment and easily swayed. Get your economic data and hit the 'mute' button. Opinions are swayed by the opinions’ of others but it doesn't make them fact. Learn this early.

Read More, Comment and Share......

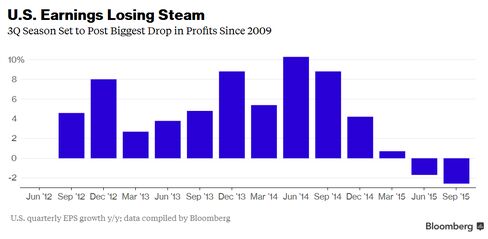

Investors may wade into unknown territory next month as the Federal Reserve readies the first rate hike in nearly a decade amid a corporate earnings recession.

S&P 500 earnings are on track to close their first reporting season of negative growth since the Great Recession and estimates call for sub-zero growth in the current quarter as well.

Even if the trend reverses next year, as expected, a Fed rate hike in December could mark an unprecedented conflict between a tightening cycle starting at the same time as earnings fall into recession.

"We can't think of any instances when the Fed was hiking during an (earnings) recession," said Joseph Zidle, portfolio strategist at Richard Bernstein Advisors in New York.

"In the last six months one can point at a lot of different things. But if you think about fundamentals, falling corporate profits and the threat of rising rates" are behind the market stalling, Zidle said.

With more than 90 percent of S&P 500 components having reported, S&P 500 e

Read More, Comment and Share......

Hat tip to BornBroke

Read More, Comment and Share......

This U.S. earnings season is on track to be the worst since 2009 as profits from oil & gas and commodity-related companies plummet leaving many to wonder, is the worst behind us or is there more to come? Is China's growth story over or taking a 'rest'? We've lived on ghost cities creating demand for so many years; where is the next growth story?

So far, about three-quarters of the S&P 500 have reported results, with profits down 3.1 percent on a share-weighted basis, data compiled by Bloomberg shows. This would be the biggest quarterly drop in earnings since the third quarter 2009, and the second straight quarter of profit declines. Earnings growth turned negative for the first time in six years in the second quarter this year.

The damage is the biggest in commodity-related industries, with the energy sector showing a 54 percent drop in quarterly earnings per share so far in the quarter, with profits in the materials sector falling 15 percent.

The picture is brighter for the telec

Read More, Comment and Share......

Read More, Comment and Share......

The small-cap market finished 3Q15 with a double-digit decline, in many ways similar to the correction investors saw around this same time last year. CEO Chuck Royce sits down with Co-CIO Francis Gannon to discuss why he believes corrections are a sign of healthy market behavior, the importance of risk management in the small-cap space, and why he thinks a new market cycle will favor companies with earnings.

More at RoyceFunds

Read More, Comment and Share......

Read More, Comment and Share......

Read More, Comment and Share......

Omega Advisors Founder, CEO and Chairman Leon Cooperman discusses his outlook for the markets. Of course he was short on time so we have no idea if he's short bonds but that would be my guess. Hat tip Sadiq for this interview.

Read More, Comment and Share......

I'm continually saving charts and data points which I find interesting but generally don't post enough to share the data. That being said, I thought "wth" and decided to share some of my most recent. Perhaps you can find a few of interest or maybe you can translate one into a trade. It certainly can't hurt. Your comments would be of interest and will be answered. Happy trading.

Online shoppers by income group. It certainly seems Amazon benefits by middle income buyers. Possibly they just don't have the 'time' to shop in a store, working 60+ hours a week and balancing soccer games, football, cheerleading practice, dinner, laundry, etc.

Jet[dot]com is now selling some items at a loss to gain marketshare from Amazon

We've had numerous talks in Chat over coal usage (is clean coal an oxymoron or what?) and this certainly backs up the belief that natural gas continues to be embraced.

Then we have a look at Bear markets of 20% or more.The average # of months caught my eye.

Read More, Comment and Share......

Intellectually I knew there were two forms of market participants already: price-sensitive “investors” and price-insensitive “traders”. The former buys low and sells high, and has a process for determining why they are doing so. The latter sells low and covers lower, or buys high and sells higher. Both are entirely legitimate ways to make returns in any market, but it’s important to distinguish between them; who you listen to and surround yourself with will inform your market view and trading positions. When the stock market opened for its “Black Monday” on August 24th, those selling were “traders”, whether they want to admit it or not. They didn’t care what level prices were at, just that they were going down. “Get me out, NOW!!!” Those who were in buying blue chip, mega-cap, high quality secular growth stories at 10 or 20% discounts to that day’s close? They were investors. More on this below, but when you’re in a crash, make sure that you’re not trying to inform investing dec

Intellectually I knew there were two forms of market participants already: price-sensitive “investors” and price-insensitive “traders”. The former buys low and sells high, and has a process for determining why they are doing so. The latter sells low and covers lower, or buys high and sells higher. Both are entirely legitimate ways to make returns in any market, but it’s important to distinguish between them; who you listen to and surround yourself with will inform your market view and trading positions. When the stock market opened for its “Black Monday” on August 24th, those selling were “traders”, whether they want to admit it or not. They didn’t care what level prices were at, just that they were going down. “Get me out, NOW!!!” Those who were in buying blue chip, mega-cap, high quality secular growth stories at 10 or 20% discounts to that day’s close? They were investors. More on this below, but when you’re in a crash, make sure that you’re not trying to inform investing dec

Read More, Comment and Share......

Wowsa! Hat tip to GT for this one. Maybe Americans need to pay attention?

Read More, Comment and Share......

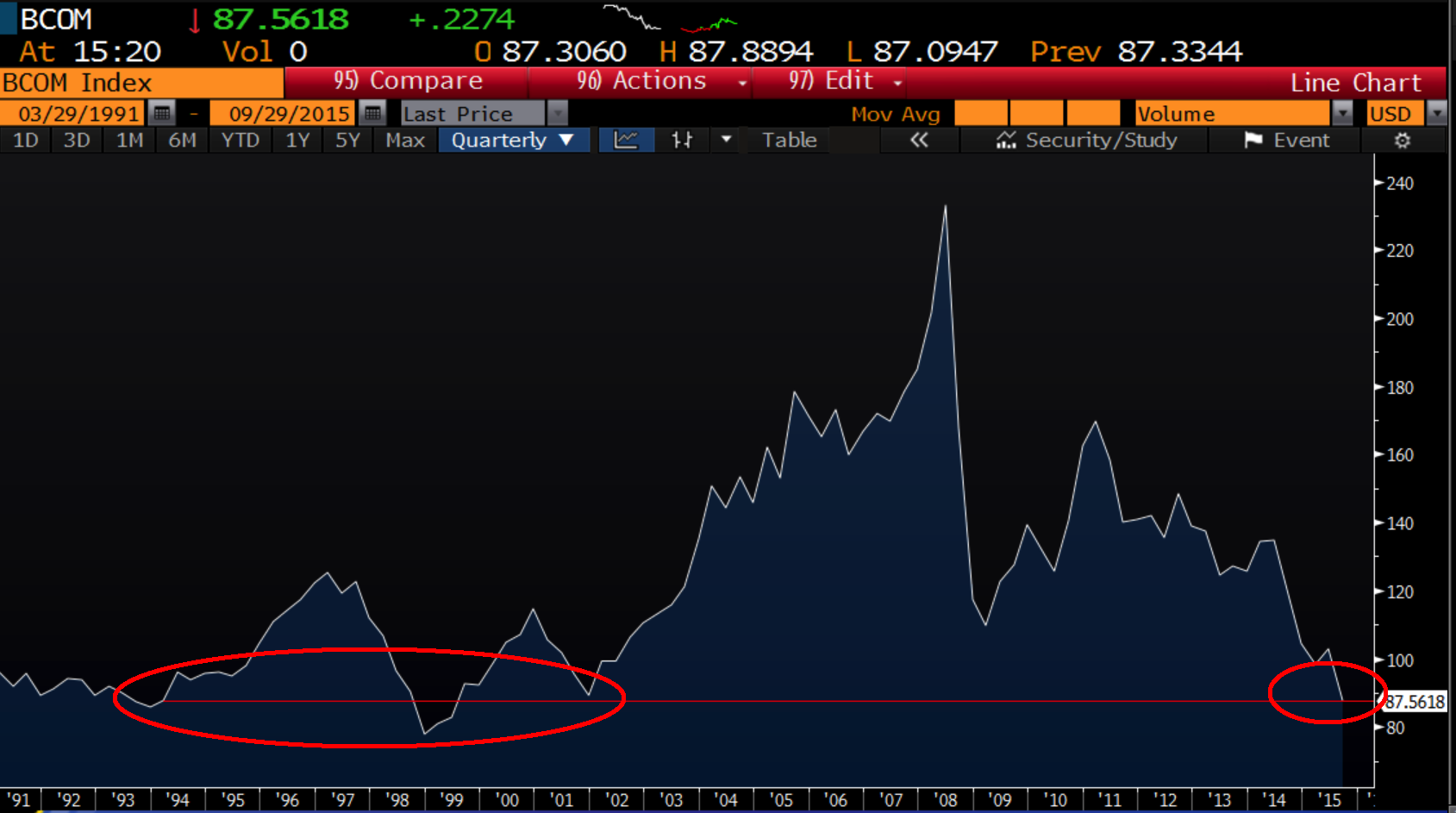

The chart above is the Bloomberg Commodity Index. It consists of baskets of common commodities, including energy, metals, foodstuffs, softs and precious metals.

The chart above is the Bloomberg Commodity Index. It consists of baskets of common commodities, including energy, metals, foodstuffs, softs and precious metals.

After a fairly flat period in the 1990s, the index leapt upward beginning in the early 2000s. The context explains the jump: High inflation, weak dollar and low interest rates. From 2001 to 2007, the dollar lost 41 percent of its value, and all commodities priced in dollars skyrocketed. At the same time, China began a huge expansion of its infrastructure, transportation, housing and manufacturing sectors. The BCOM index moved from around 90 to almost 240.

You know the rest of the story: Inflation is nowhere to be found, and the Federal Open Market Committee is concerned about deflation. The dollar is at multiyear highs against just about any other currency. Commodity prices have suffered as a result.

Oil prices have been cut almost in half compared with a year ago, to $45 from $87. They are down more than 60 percent from the pe

Read More, Comment and Share......

Worldwide money flows are of interest to a long term investor and the flight out of emerging markets has been striking. Weren't emerging markets supposed to where our expansion was to take place? What now?

According to the IIF, the volatile market conditions have taken a toll on capital flows to emerging markets, with net non-resident portfolio flows in August falling into negative territory for the first time in 2015, according to the Institute of International Finance’s latest EM Portfolio Flows Tracker. Outflows were estimated at $4.5 billion in August compared to inflows of $6.7 billion in July.

“Portfolio flows to emerging markets have retreated sharply in the last few weeks,” said Charles Collyns, chief economist at the IIF. “Emerging market investors have been spooked by rising uncertainty about China, and stress has been exacerbated by a combination of fundamental concerns about EM economic prospects and volatility in global financial markets.”

Emerging market equity flows f

Read More, Comment and Share......

The recent Volkswagen scandal had me wondering about past auto manufacturer scandals and how their prices (individual or sector wide) were affected. Here's a piece by ProPublica which brought back memories. Especially the Pinto issue, which affected me as I learned to drive stick in a Pinto in the 1970s. Boy, the mind reels!

The recent Volkswagen scandal had me wondering about past auto manufacturer scandals and how their prices (individual or sector wide) were affected. Here's a piece by ProPublica which brought back memories. Especially the Pinto issue, which affected me as I learned to drive stick in a Pinto in the 1970s. Boy, the mind reels!

The recent revelation that Volkswagen used software to make its diesel engines appear to be polluting less than they are is just one of a long list of scandals that have plagued the auto industry. Here is a selection of some of the best reporting on the subject.

Mother Jones, 1977

The Ford Pinto was rushed into production in the early 1970s despite the company knowing that the gas tank could explode in a rear-end collision. Ford decided to do nothing about it because a cost-benefit analysis showed that it was cheaper to pay legal costs for an expected number of future victims than to fix the cars.

Read More, Comment and Share......

"A few outsiders saw what no one else could". Hat tip to sadiq. With so many big stars, I'll be watching this one.

Read More, Comment and Share......

Apple has owned up to a rare incursion of malicious software into its App Store, forcing it to pull some of the most widely used mobile apps in China from the service.

Apple has owned up to a rare incursion of malicious software into its App Store, forcing it to pull some of the most widely used mobile apps in China from the service.

Late on Sunday in California, the iPhone and iPad maker confirmed reports by security researchers who had warned that a swath of popular Chinese apps had been created using developer tools that were infected with the malware, resulting in the compromised apps.

“Hundreds of millions” of users of the popular Chinese apps were at risk of having their personal data exposed, including people who use Tencent’s WeChat mobile messaging service and ride-hailing app Didi Kuaidi, according to Palo Alto Networks, a US cyber security company.

Apple said it had removed the infected apps, which had been created with what it said was a fake version of its software for app developers, known as Xcode.

It did not explain how developers of a large number of China’s most widely used mobile services had all been infected with the same piece o

Read More, Comment and Share......

You can't use this site and its products or services without agreeing to the terms and conditions and privacy policy.

We welcome you to post a blog entry, oped or share your daily reading with us as long as it is relevant to the topic of investing and not an attempt to sell a product, proprietary strategy, platform or other service. Please provide links to any research data and if re-posting other articles, give credit where credit is due providing a back link to the original site.

300 words minimum per post. You may also sort by category or search by topic. Don't forget to comment and please "share" via Facebook, Twitter and Google+. If you have any questions, please contact us.

__________________