This caught my eye as I tend to look at stocks when they near a significant, long-term support such as a 100 month or 200 month EMA or SMA. Of course I'm buying with a long term perspective in this approach but it got me wondering: Is is better to hold your breath and simply buy stocks when they've sold off 20%? The downside still terrifies me but looking at historical returns is intriguing. From Awelathofcommonsense:

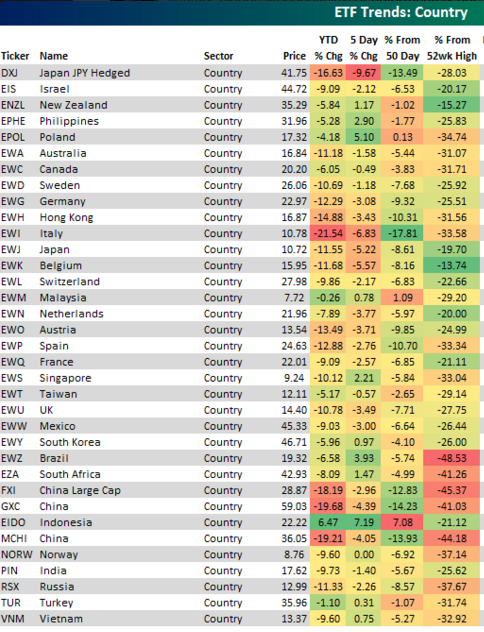

Large cap U.S. equities continue to hold up well with the S&P 500 down roughly 12% from its all-time highs reached last spring. To some degree, this performance has masked the global bear market going on in the rest of the world. Take a look at this list of country ETFs from Bespoke Investment Group:

The average drop from the 52-week high on this list is just shy of 30%. Not too pretty. But beauty is in the eye of the beholder in these situations. Historically, buying global stocks after they have fallen into bear market territory has been rewarding for investors.

I