RJ Insights.pdf

Mining stock recommendations, observations on Dollar/Gold rallies.

Read More, Comment and Share......

RJ Insights.pdf

Mining stock recommendations, observations on Dollar/Gold rallies.

Read More, Comment and Share......

Read More, Comment and Share......

While running a simple screen for Cheap Growth stocks, I had something unusual happen. There was not a single stock that met the criteria. That's right, zero, zilch, nada. The screen only had three criteria; a PEG ratio of .75 or lower, a debt to equity ratio of .8 or lower, and an expected growth rate of 25% for the next 5 years. Only two possible conclusions can be drawn from this. Conclusion A, growth stocks are way over valued at this time. Conlusion B, analyst estimates for earnings growth are still very bearish, too bearish in fact.

My past experience with this screen leads to me too conclusion B. I started using this screen six months prior to the beginning of the bear market. At that time, there was no shortage of cheap growers. In fact I had to add a market cap component to reduce the number of possible candidates. Since the screen depends heavily on analyst earnings estimates and considering the events that occurred half a year later, I would conclude that analysts were too

Read More, Comment and Share......

Read More, Comment and Share......

Read More, Comment and Share......

Read More, Comment and Share......

This has a lot of good information in it. It's in pdf format so you can download it and keep it for future reference..C.pdf

Read More, Comment and Share......

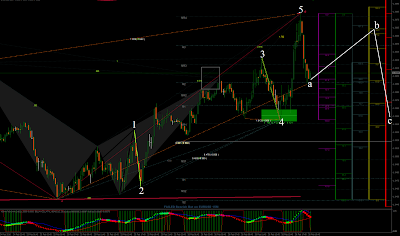

I don't agree with this particular count either, but I think it's worth taking a look at. He certainly could be right...I do think the 1158 target makes sense as a short-term objective, though. http://bit.ly/cFMZ7p

Read More, Comment and Share......

Read More, Comment and Share......

Read More, Comment and Share......

Read More, Comment and Share......

One of the most important lessons I learned in business is that a personal recommendation is more valuable and more trusted than any advertising or promotion in the world; and it's true. That's what our badge is all about.

You'll notice this little box on our Main page saying "Do You StockBuz?". By clicking on this badge, you will be allowed to customize a badges size and color to embed in your blog, webpage, other forums or sites you navigate each day as evidence you enjoy your experience here and wish to turn others on to it.

I hope you are enjoying our new home as much as I and I hope you will use this badge to help us grow, as we build a new home for other investors just like us, sharing from across the globe with different interests and levels of expertise. Thank you for being part of our community and spread the word. Do You StockBuz?

Added 3/30/10: I have discovered that this badge does not embed on a site which does not allow integration of flash products - such as Wor

Read More, Comment and Share......

Since some of you trade NG and UNG, I thought I'd put some Fibonacci on it and see what it looks like. This is the hourly chart. From the 02/08 high, notice that XA drops to a previous support area. The rally AB retraces .786 of XA. The BC selloff takes out the low of XA and extends 1.618 to today's low. There is also a Fibonacci time target right here that I didn't label. It should rally from here and try to fill that gap. However, what I'm concerned about is that we closed below the Jan 28 low. Momo still down. If a rally attempt to fill the gap fails and today's low is taken out, it will probably extend 2.618 which would take it down near 8.70..

Read More, Comment and Share......

The QQQQ's have held the red Kijun(Trend Line) for three weeks. Last week it managed to close higher after the previous weeks doji and also managed to close above the 20wk ema, a commonly used mav on Ichimoku charts. Next resistance is the light blue Tenkan line around 44.38. It looks constructive at this point although the blue 90wk mav is still ticking lower. What I would like to see next week is a move higher with a weekly close above the high of the previous red candle. I would appreciate any and all feedback.

Read More, Comment and Share......

Read More, Comment and Share......

Read More, Comment and Share......

Read More, Comment and Share......

Read More, Comment and Share......

Read More, Comment and Share......

Read More, Comment and Share......

You can't use this site and its products or services without agreeing to the terms and conditions and privacy policy.

We welcome you to post a blog entry, oped or share your daily reading with us as long as it is relevant to the topic of investing and not an attempt to sell a product, proprietary strategy, platform or other service. Please provide links to any research data and if re-posting other articles, give credit where credit is due providing a back link to the original site.

300 words minimum per post. You may also sort by category or search by topic. Don't forget to comment and please "share" via Facebook, Twitter and Google+. If you have any questions, please contact us.

__________________