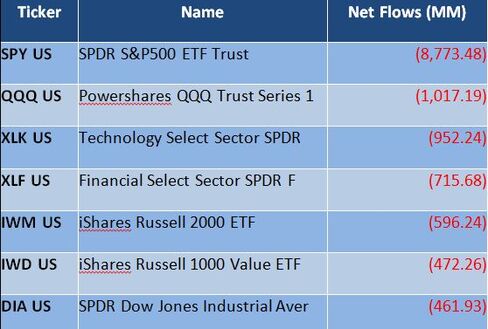

When first-generation ETFs launched in the 1990s—such as the SPDR S&P 500 Trust (SPY) and the PowerShares QQQ Trust Series 1 (QQQ)—lead this year's outflows, that is a sign that institutional investors are scared. These first-to-market ETFs have the ample liquidity that big institutions tend to love, with many trading more than $500 million in volume a day. While newer ETFs that may do the same thing or more for cheaper have been launched in the intervening years, early ETFs still tend to curry favor with large investors that value liquidity. These investors tend to be more tactical, and thus outflows from these ETF stalwarts are a bearish sign.

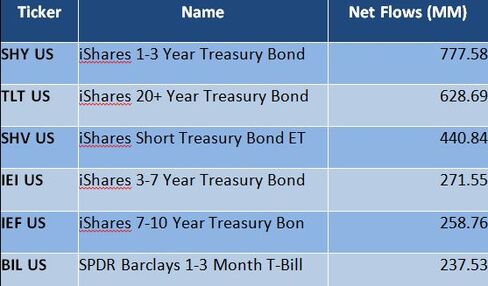

U.S. Treasuries of all maturities are raking in cash

According to Bloomberg, when U.S. Treasury ETFs are the brightest bright spot, that's not good. They have taken in more than $3 billion in net new cash (while junk bond ETFs have seen $2 billion in outflows). What is especially bearish is that the inflows into Treasury ETFs are spread across all maturities. This signals a flight to quality as opposed to positioning around a Fed move. The table below shows the variety of Treasury ETFs taking in cash to start year.

Comments