Are we officially in the process of being caught off guard?

I wasn’t even going to write a note this morning, because it’s Sunday and I have a couple pieces planned for the week to come. But then I had an interesting set of realizations this morning while walking to get my coffee:

Many young people on Wall Street nowadays have never experienced real volatility in markets

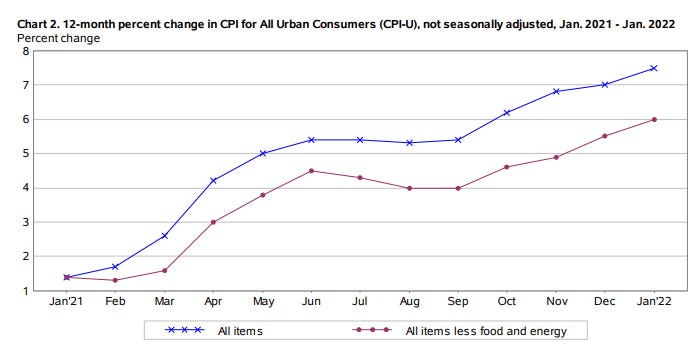

Russia’s invasion of Ukraine and inflation at 7.5% in the U.S. are two extremely different, complex and unmapped pieces of terrain that we are going to be forced to navigate

In other words, we have a ton of inexperienced market participants that should be bracing for the economic shock of their lifetimes, but they’re not - they’re still at the stage where walking around Manhattan in Patagonia vests, drinking Starbucks and making dinner reservations at whatever douche-motel is trendy this week are among their top concerns.

This wasn’t a big deal when I first pointed out in November that I thought the NASDAQ could crash. We weren’t dealing with Russia or inflation just 5 months ago.

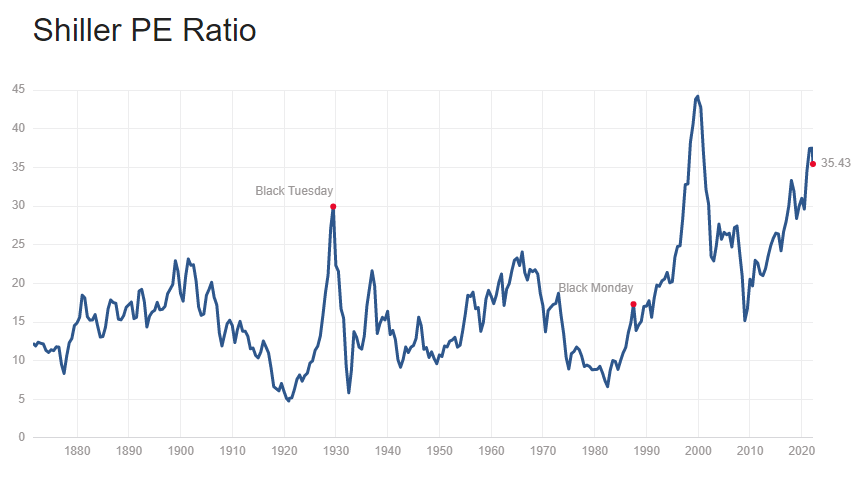

In that same short span of time, risks to markets have gone from non-existent, to potentially grave. 5 months is nothing; it’s a split second when gauged relative to the reaction times of 27 year old guys named Kyle who help draw up models to justify 45x P/Es on sell side reports.

And I think there’s a chance shit gets real for the Kyles, the Tylers and the Jordans working on Wall Street, in addition to a lot of other “investors” who got their financial education from 2AM Tik Tok videos, YouTube livestreams and Twitter spaces calls with AMC “apes”, very soon.

While market pullbacks over the last two decades have been akin to light breeze on a summer day, a coming supercycle of discomfort, where the U.S. dollar is challenged and our debt may actual come due, could be a Category 5 hurricane.

And nobody has even considered “evacuating” markets yet.

The housing crisis was almost 15 years ago at this point. We’ve had the better part of 2 decades of nothing but synthetic, Fed produced heroin, mainlined into our brokerage accounts since then.

I have a long railed against what I have called this “arrogant” monetary policy: the idea that we can micromanage the economy in a way that is going to make everybody comfortable, all the time.

I have argued that the feeling of entitlement that comes with expecting to be comfortable all the time goes beyond being “arrogant”: it’s just plain unreasonable. The laws of nature - no matter what industry we’re talking about - all but guarantee some discomfort somewhere along the way.

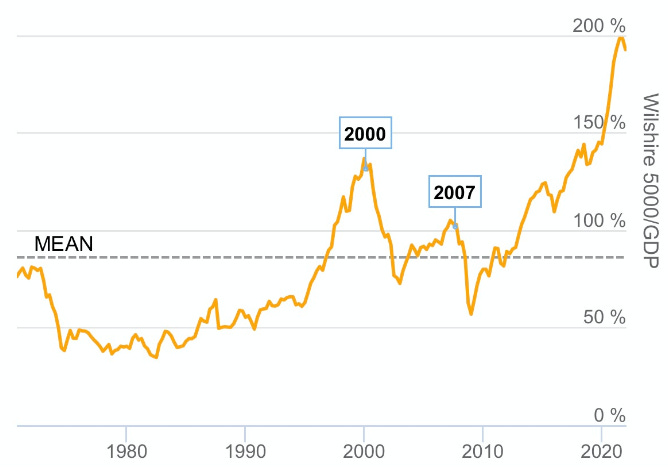

This is a lesson that I think we’re going to be learning the hard way this year, and potentially for years to come. Over the last 20 years, we have watched people make fortunes in the market simply by guessing a stock and pouring money into it while the Fed backstops markets from ever moving lower.

We have overdrawn ourselves at the bank, so to speak, as much as humanly possible. Not only have companies with terrible financials been bid up, they have been bid up to fever pitch valuations that – even in the best of financial circumstances - no company should really ever be afforded.

And in addition to discomfort, one of nature’s guarantees is often reversion to the mean. Reversion to the mean becomes far more painful the further off the path of normalcy you have drifted. Heading into 2022, after two years of unprecedented and basically unlimited quantitative easing, which was lopped on top of two decades of additional quantitative easing, we’ve gotten about as far off that path as possible.

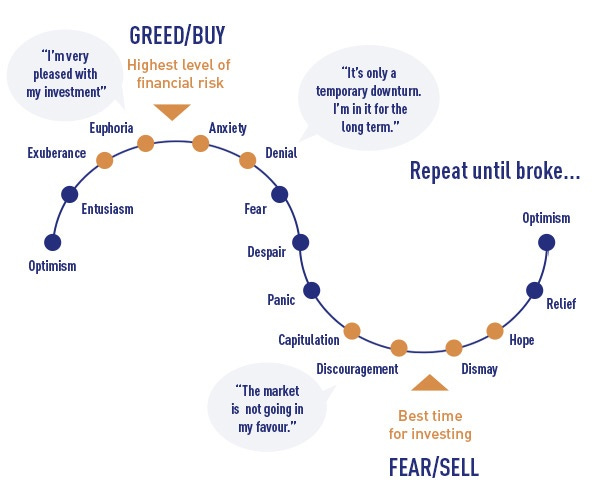

In addition to veering off course, the shock of running headfirst into two immoveable monoliths of volatility - the Fed attempting to curb unrelenting and blistering inflation and an unprovoked invasion of a sovereign nation in Europe - may have only just begun to be absorbed by markets. There’s a reason that the cycle of markets diagram, when swinging lower, starts with “anxiety” and “denial”.

We haven’t even begun to approach “fear” yet, because markets have sold off in orderly fashion. This was the cornerstone of my prediction that we are still due for a limit down morning and real capitulation one of these days.

The truth is that while many investors see this as simply another “BTFD” moment like we’ve had in years’ past, we haven’t even started to ponder the long-lasting effects of what could be coming down the pike for U.S. markets, the U.S. dollar and geopolitical tensions.

Today’s blog post has been published without a paywall because I believe the content to be far too important. However, if you have the means and would like to support my work by subscribing, I’d be happy to offer you 22% off to become a subscriber in 2022:

The Fed doesn’t have any other option but to hike, in my opinion - regardless of what happens in Ukraine.

Either the Fed will allow the American public to suffer through continued unprecedented inflation, which will have psychological and monetary effects on the American consumer the likes of which we’ve never seen, or they will be consistently hiking rates, which will start the countdown on a ticking time bomb of debt and malinvestment that has been gestating and growing since 1999. Given that the geopolitical conflict is making inflation worse than it was when CPI was 7.5%, the Fed is going to have to react - even if it’s just for show.

And Russia’s invasion of Ukraine is an all out wild card. Nobody knows what path it is going to go down or how it will end. Analysts have drawn up scenarios ranging from a cease-fire tomorrow to a full-on nuclear holocaust. And while there are hopes for a temporary cease-fire, which would at least stop the humanitarian crisis of killing of innocent civilians, the shockwaves on the global economic system and the geopolitical implications of Russia’s actions are likely to stick around for years to come.

In fact, I wrote a week ago that I believe this invasion marks the beginning of Russia and China’s official war on the U.S. dollar as the global reserve currency.

Both rate hikes and the geopolitical conflict will have effects, even in a best case scenario, that linger for years to come. The number of potential outcomes that can occur as a result of these effects that also end with the market moving to all time highs over the next few years, has dwindled. The outcomes that do result in new all-time highs - hyperinflation and QE - would have devastating consequences that would make the market’s move higher, in nominal terms, moot.

Perhaps over long periods of time, the market may move higher in real terms once again, but appear to clearly be entering a stagflationary period of discomfort that many “analysts” couldn’t have ever fathomed just months ago.

And if analysts couldn’t have predicted it, markets - commodity markets, equity markets, debt markets, FX markets and otherwise – may only be pricing in the very, very beginning of this new era for the United States.

The “new era” of discomfort may not last weeks, months or years, but rather decades, especially if the U.S. dollar is finally called into question as the world’s reserve currency.

This coming week, I’ll be publishing an article that asks about the opposite idea: is it possible for us to get through this and put it behind us relatively quickly? In fact, I’ll even urge my readers to think about whether or not the worst could be over. But this morning, I couldn’t help but feel that – even in a situation where the volatility dies down – the market’s discomfort could be long lasting.

If we are, in fact, approaching a new epoch of discomfort for investing in the U.S. (which, by the way I hate to say that we probably deserve), investors’ reactions in the public markets have still not reflected the size of the potential volatility going forward.

There’s a part of me that still believes markets need to move 30% or 40% lower just based on Fed rate hikes alone, as I predicted weeks ago. Throwing into the mix a new, uncharted geopolitical relationship with Russia and Putin as the “wild card”, I can’t help but feel that the odds of long lasting discomfort have spiked profoundly.

And remember: the next crisis, we may not be able to print our way out of anymore…

Courtesy of quoththeraven

Comments