While Google and Facebook are the undisputed advertising leaders online, companies are increasingly looking for other digital ways to spend their marketing budgets, according to advertising and public relations company WPP CEO Sir Martin Sorrell.

"What our clients want and what our agencies want is more competition of the space, anything that gives more competition to the duopoly of Facebook and Google," Sorrell said to CNBC.

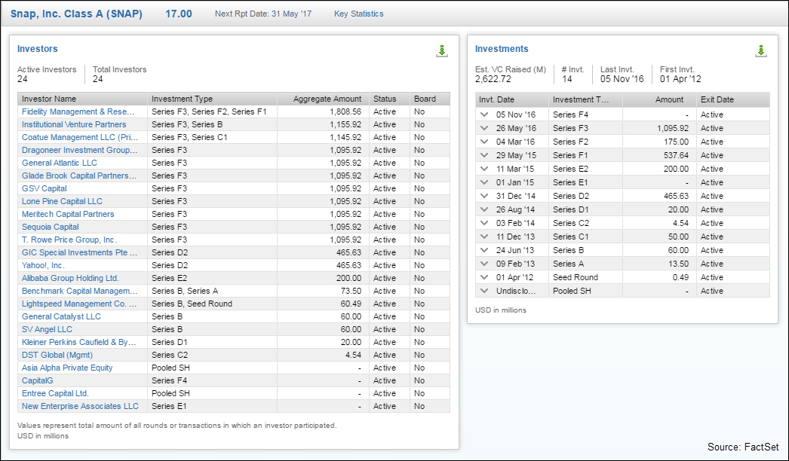

The two tech giants account for about 75 percent of digital ad budgets, according to Sorrell. But, there are competitors ready to chip away at their dominance, including AOL and Yahoo's ad tech platforms and Snap. Even Amazon is becoming a threat, with its ad platform recently valued at $350 billion, he pointed out.

"Getting more than two solutions is important," he said.

But while Google's issue of ads appearing next to questionable content is causing companies to pull dollars right now, Sorrell doesn't think the moves will be permanent because of how big of