Individuals from less privileged backgrounds may face higher barriers to entry into prestigious positions, meaning only the most skilled advance and succeed.

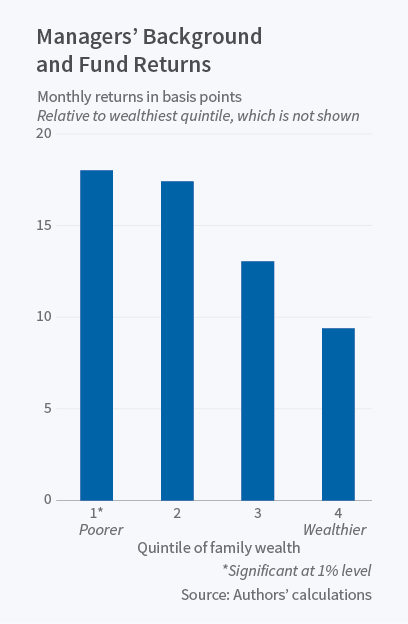

In Family Descent as a Signal of Managerial Quality: Evidence from Mutual Funds (NBER Working Paper No. 22517), Oleg Chuprinin and Denis Sosyura find that mutual fund managers from poor families consistently achieve better investment results than fund managers from wealthier backgrounds. The researchers also find significant differences in promotion patterns and trading styles between these two types of fund managers.

Previous studies about the relationship between managers' upbringing and their performance have focused on educational differences, including whether the managers attended elite universities or had access to education-related networks of influential people who could later help boost their careers. Such studies tend to find that managers with a stronger educational background tend to deliver better performance.