Your hear the reassuring echos all of the time. "Don't worry! The market will always come back." But do they? What about dividend reinvesting and adjusted for inflation? Given the data, one can easily

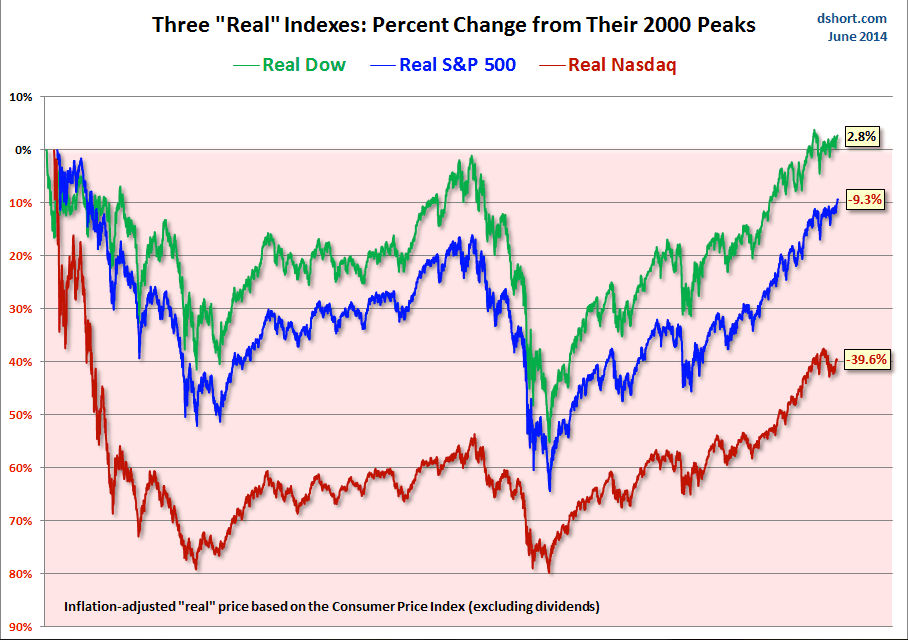

Consider these two overlays — one with the nominal price, excluding dividends, and the other with the price adjusted for inflation based on the Consumer Price Index for Urban Consumers (which I usually just refer to as the CPI). The charts below have been updated through today's close.

The charts require little explanation. So far the 21st Century has not been especially kind to equity investors. Yes, markets usually do bounce back, but often in time frames that defy optimistic expectations.

The charts above are based on price only. But what about dividends? Would the inclusion of dividends make a significant difference? I'll close this post with a reprint of my latest chart update of the S&P 500 total return on a $1,000 investment at the 2000 high.

Total return, including reinvested dividends, certainly looks better, but the real (inflation-adjusted) purchasing power of that $1,000 is currently, over 14 years later, only 191 dollars above break-even. That equates to a 1.24% annualized real return.

(hat tip member GT)Data courtesy of Investing.com

Comments