Before I present the insight on expected earnings ahead, there is one point I wish to make; that being Trump. If you're not following our President elect on Twitter, you should get with it now. Some may say it's not "Presidential" to be on TWTR but our commander and chief does what he wishes, and he wishes to scare whomever he can. At the very least, throw him up as a column on TweetDeck and watch the charts fly when he mentions a name.

Now while AMZN and GM were formerly expecting good growth in 2017, you will notice that both are now on Trumps radar for taxation and import/export fees which explains their recent trading action. There seems to be no love lost between AMZN owner Jeff Bezos. Even Trumps comments on taxation such as “If @amazon ever had to pay fair taxes, its stock would crash and it would crumble like a paper bag." should leave investors more than a tad concerned. At this point, I feel we'll see quite a bit of this concern over China/Mexico/taxation/tariffs in the next few months but in the meantime, there's always the Trump trades to rely on. Read on:

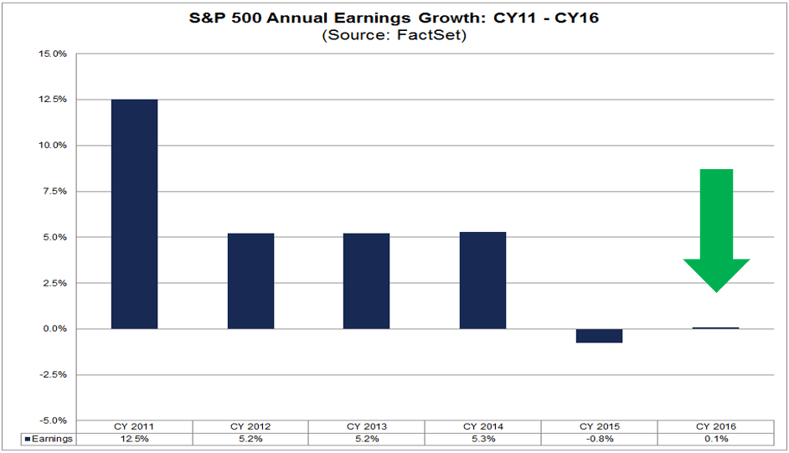

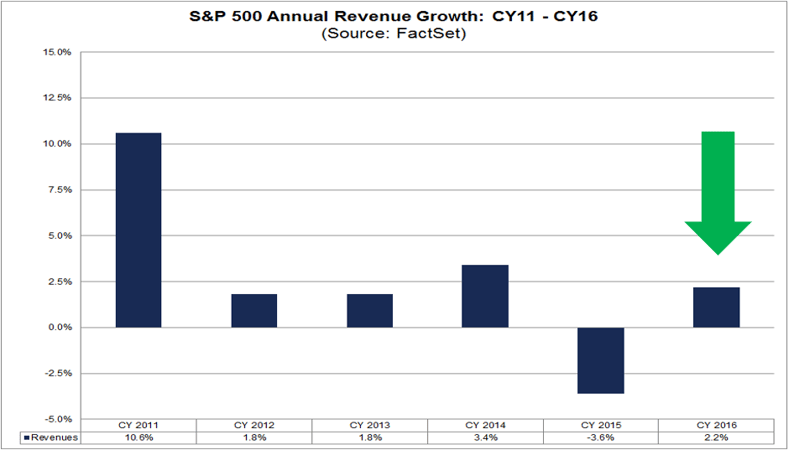

At the start of 2016, analysts were projecting earnings growth of 5.3% and revenue growth of 4.4% for the year. For the first half of 2016, the index reported declines in earnings and revenues. For the second half of 2016, the index is expected to report growth in earnings and revenues. Overall for the entire year, analysts believe the index will report slight growth in both earnings and revenues.

Here, we look at the expected earnings and revenue growth rate for the S&P 500 for 2016, with a focus on the top and bottom performing sectors, industries and companies for the year.

Slight Earnings Growth of 0.1% Expected for 2016

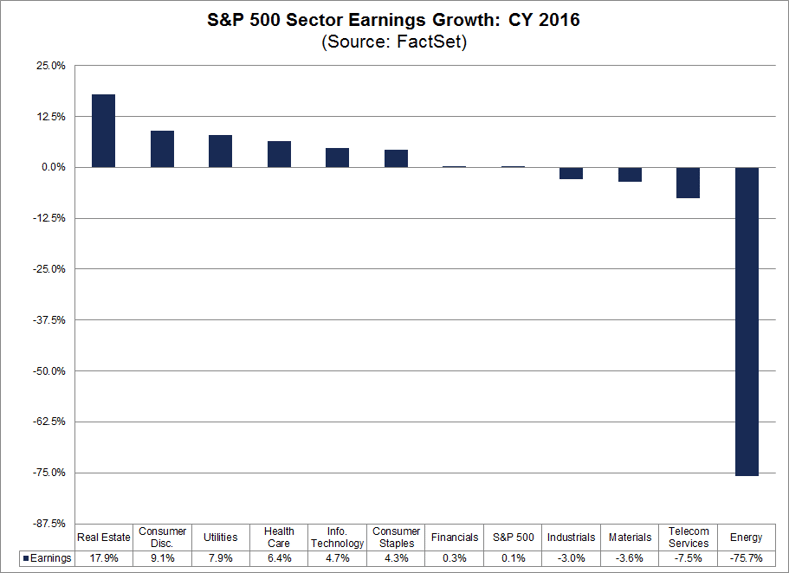

The estimated earnings growth rate for CY 2016 is 0.1%. Seven sectors are projected to report year-over-year growth in earnings, led by the Real Estate, Consumer Discretionary, and Utilities sectors. Four sectors are projected to report a year-over-year decline in earnings, led by the Energy sector.

Real Estate: Equity Residential and HCP Lead Growth

The Real Estate sector is expected to report the highest earnings growth rate of all eleven sectors at 17.9%. At the sub-industry level, five of the eight sub-industries in this sector are projected to report earnings growth for the year, led by the Health Care REITs (223%) and Residential REITs (111%) sub-industries. At the company level, Equity Residential and HCP are the largest contributors to earnings growth for this sector. The EPS growth for Equity Residential is benefitting from an unusually high EPS estimate for CY 2016, while the EPS growth for HCP is benefitting from a comparison to an unusually low EPS actual for CY 2015. The mean EPS estimate for CY 2016 for Equity Residential is $10.87, compared to year-ago EPS of $2.36. The mean EPS estimate for HCP for CY 2016 is $1.30, compared to year-ago EPS of -$1.21. If these two companies are excluded, the estimated earnings growth rate for the Real Estate sector would fall to -8.6% from 17.9%.

Consumer Discretionary: Internet & Direct Marketing Retail Leads Growth

The Consumer Discretionary sector is projected to report the second highest earnings growth rate of all eleven sectors at 9.1%. At the industry level, eleven of the twelve industries in this sector are predicted to report earnings growth for the year. Of these eleven industries, four are projected to report earnings growth of more than 10%, led by the Internet & Direct Marketing Retail (49%) and Household Durables (27%) industries. At the company level, Amazon.com, General Motors, and Charter Communications are the largest contributors to earnings growth for the sector. The mean EPS estimate for CY 2016 for Amazon.com is $4.84, compared to year-ago EPS of $1.25. The mean EPS estimate for General Motors for CY 2016 is $6.02, compared to year-ago EPS of $5.02. The mean EPS estimate for Charter Communications for CY 2016 is $3.68, compared to year-ago EPS of -$2.69. If these three companies are excluded, the estimated earnings growth rate for the Consumer Discretionary sector would fall to 5.6% from 9.1%.

Utilities Sector: NRG Energy Leads Growth

The Utilities sector is predicted to report the third highest earnings growth rate of all eleven sectors at 7.9%. At the industry level, all four industries in this sector are expected to report earnings growth for the year, led by the Independent Power & Renewable Electricity Producers (101%) industry. At the company level, 22 of the 28 companies in the sector (79%) are expected to report EPS growth for CY 2016. NRG Energy is the largest contributor to earnings growth in the sector. The mean EPS estimate for NRG Energy is for CY 2016 is $1.05, compared to year-ago EPS of -$0.48. If NRG Energy is excluded, the estimated earnings growth rate for the Utilities sector would fall to 5.8% from 7.9%.

Energy: Broad-Based Weakness

The Energy sector is predicted to report the largest year-over-year decline in earnings of all eleven sectors at -75.7%. Five of the six sub-industries in this sector are expected to report a year-over-year drop in earnings: Oil & Gas Exploration & Production (N/A), Oil & Gas Equipment & Services (-92%), Oil & Gas Drilling (-82%), Oil & Gas Refining & Marketing (-61%), Integrated Oil & Gas (-49%). The only sub-industry expected to report growth in earnings for CY 2016 is the Oil & Gas Storage & Transportation (2%).

Telecom Services: Level 3 Communications Leads Decline

The Telecom Services sector is expected to report the second largest (year-over-year) earnings decline of all eleven sectors at -7.5%. Overall, four of the five companies in the sector (80%) are projected to report a decrease in EPS for the year. The one company that is driving the earnings decline for this sector is Level 3 Communications. However, the EPS decrease for this company is exacerbated by a comparison to unusually high earnings in CY 2015, due to unusually high EPS reported in Q4 2015. In the company’s earnings release from Q4 2015, Level 3 Communications stated (regarding EPS for the quarter), “This includes a non-cash benefit to the fourth quarter Income Tax Expense of approximately $3.3 billion related to the release of the company’s valuation allowance against U.S. federal and state deferred tax assets…” The mean EPS estimate for Level 3 Communications for CY 2016 is $1.59, compared to year-ago EPS of $9.58. If this company is excluded, the estimated earnings decline for the Telecom Services sector would drop to -0.1% from -7.5%.

Revenue Growth of 2.2% Expected for 2016

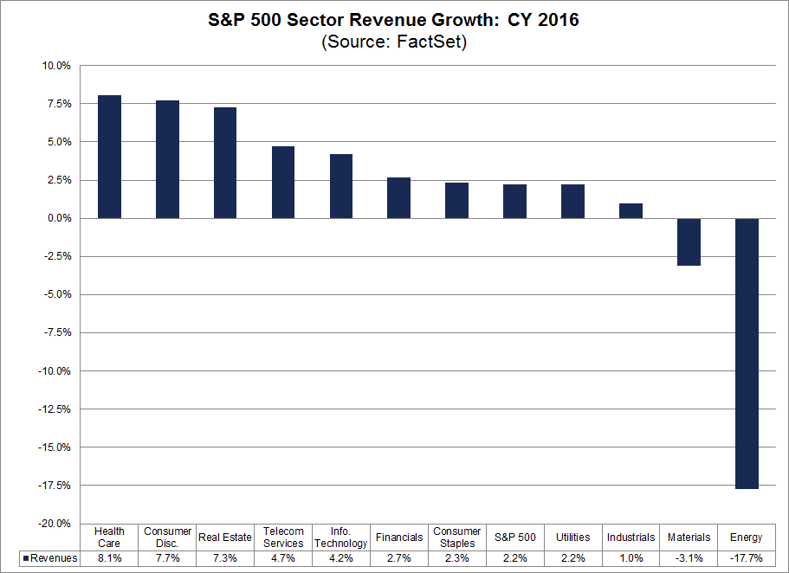

The estimated revenue growth rate for CY 2016 is 2.2%. Nine sectors are expected to report year-over-year growth in revenues, led by the Health Care, Consumer Discretionary, and Real Estate sectors. Two sectors are expected to report a year-over-year decline in revenues, led by the Energy sector.

Health Care: Broad-Based Growth

The Health Care sector is projected to report the highest revenue growth of all eleven sectors for CY 2016 at 8.1%. All six industries in this sector are expected to report sales growth for the year: Health Care Providers & Services (9%), Health Care Technology (9%), Life Sciences Tools & Services (6%), Biotechnology (6%), Pharmaceuticals (5%), and Health Care Equipment & Supplies (5%).

Consumer Discretionary: Internet & Direct Marketing Retail Leads Growth

The Consumer Discretionary sector is projected to report the second highest revenue growth rate of all eleven sectors for CY 2016 at 7.7%. At the industry level, ten of the twelve industries in this sector are predicted to report sales growth for the year. Of these ten industries, three are projected to report revenue growth of more than 10%: Internet & Direct Marketing Retail (27%), Household Durables (17%), and Media (13%).

Real Estate: Equity Residential and HCP Lead Growth

The Real Estate sector is expected to report the third highest revenue growth rate of all eleven sectors at 7.3%. At the sub-industry level, seven of the eight sub-industries in this sector are projected to report sales growth for the year, led by the Real Estate Services (21%), Industrial REITs (13%) and Specialized REITs (11%) sub-industries.

Energy: Broad-Based Decline

On the other hand, the Energy sector is expected to report the largest year-over-year decrease in sales of all eleven sectors for CY 2016 at -17.7%. All six sub-industries in the sector are predicted to report a decrease in revenues: Oil & Gas Drilling (-43%), Oil & Gas Equipment & Services (-31%), Oil & Gas Exploration & Production (-21%), Integrated Oil & Gas (-16%), Oil & Gas Refining & Marketing (-15%), and Oil & Gas Storage & Transportation (-2%).

Energy Sector Largest Drag on Growth in 2016

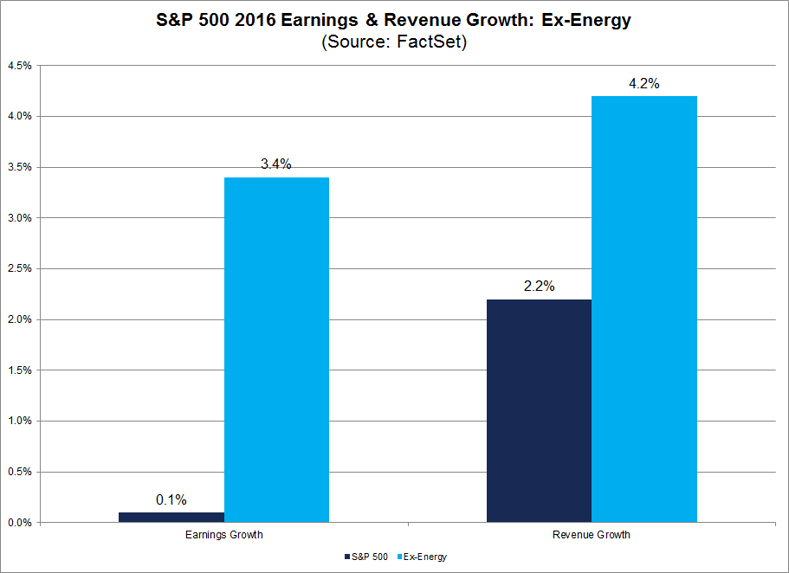

Not only is the Energy sector expected to report the largest year-over-year declines in earnings and revenues for 2016, it also is the largest detractor to the estimated earnings and revenue growth rates for the S& P 500 for 2016. If the Energy sector is excluded, the estimated earnings growth rate for the S&P 500 would jump to 3.4% from 0.1%, and the estimated revenue growth rate for the S&P 500 would jump to 4.2% from 2.2%.

Courtesy of FactSet

Comments