With “Black Friday” here, the performance of retailers will be a focus for the markets. As of today, which retailers in the S&P 500 are projected to see the highest and lowest year-over-year earnings growth for the fourth quarter? Which retailers in the index have seen the largest upward and downward revisions to earnings estimates for Q4 over the past two months?

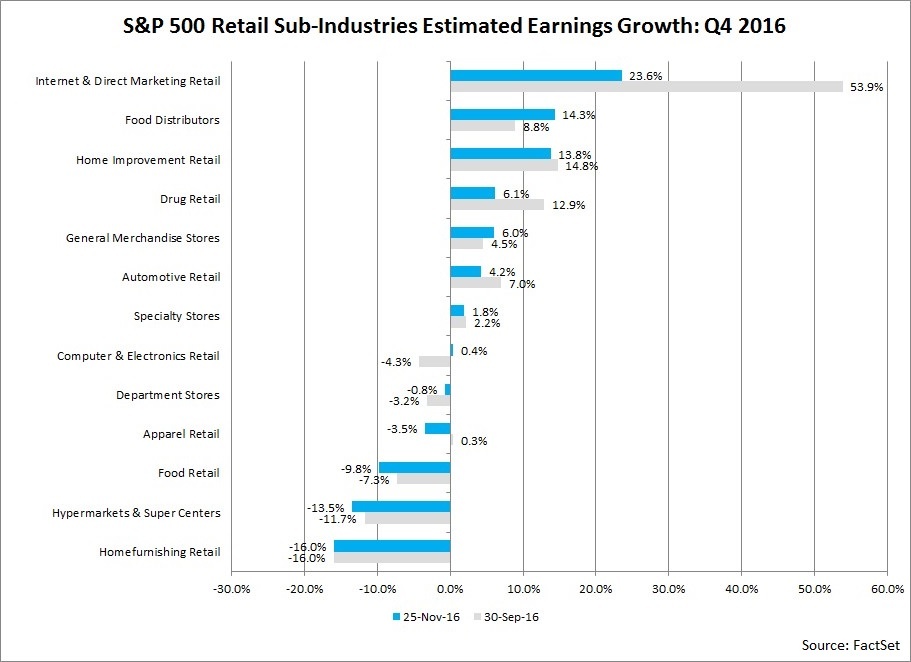

In terms of year-over-year earnings growth, seven of the 13 retail sub-industries in the S&P 500 are predicted to report growth in earnings for the fourth quarter, led by the Internet & Direct Marketing Retail (23.6%), Food Distributors (14.3%), and Home Improvement Retail (13.8%) sub-industries. On the other hand, six of the 13 retail sub-industries in the S&P 500 are predicted to report declines in earnings, led by the Home Furnishing Retail (-16.0%), Hypermarkets & Super Centers (-13.5%), and Food Retail (-9.8%) sub-industries.

Revisions to Estimates

In terms of upward revisions to earnings estimates, four sub-industries have recorded an increase in expected earnings growth since the start of the quarter, led by the Food Distributors (to 14.3% from 8.8%) and Computers & Electronics Retail (to 0.4% from -4.3%) sub-industries. In the Food Distributors sub-industry, Sysco (to $0.53 from $0.51) has recorded upward revisions to EPS estimates during this period. In the Computers & Electronics Retail sub-industry, Best Buy (to $1.66 from $1.58) has witnessed upward revisions to EPS estimates over this time frame.

In terms of downward revisions to earnings estimates, eight sub-industries have recorded a decrease in expected earnings growth since September 30, led by the Internet & Direct Marketing Retail (to 23.6% from 53.9%) and Drug Retail (to 6.1% from 12.9%) sub-industries. In the Internet & Direct Marketing Retail sub-industry, Amazon.com (to $1.45 from $2.13) has recorded the largest downward revisions to EPS estimates during this period. In the Drug Retail sub-industry, both CVS (to $1.67 from $1.79) and Walgreens Boots Alliance (to $1.11 from $1.17) have recorded downward revisions to EPS estimates over the past two months.

It is interesting to note that despite recording the largest decline in expected earnings growth over the past two months for all S&P 500 retail sub-industries, the Internet & Direct Marketing Retail sub-industry is still expected to report the highest earnings growth of all S&P 500 retail sub-industries at 23.6%.

Courtesy of FactSet

Comments