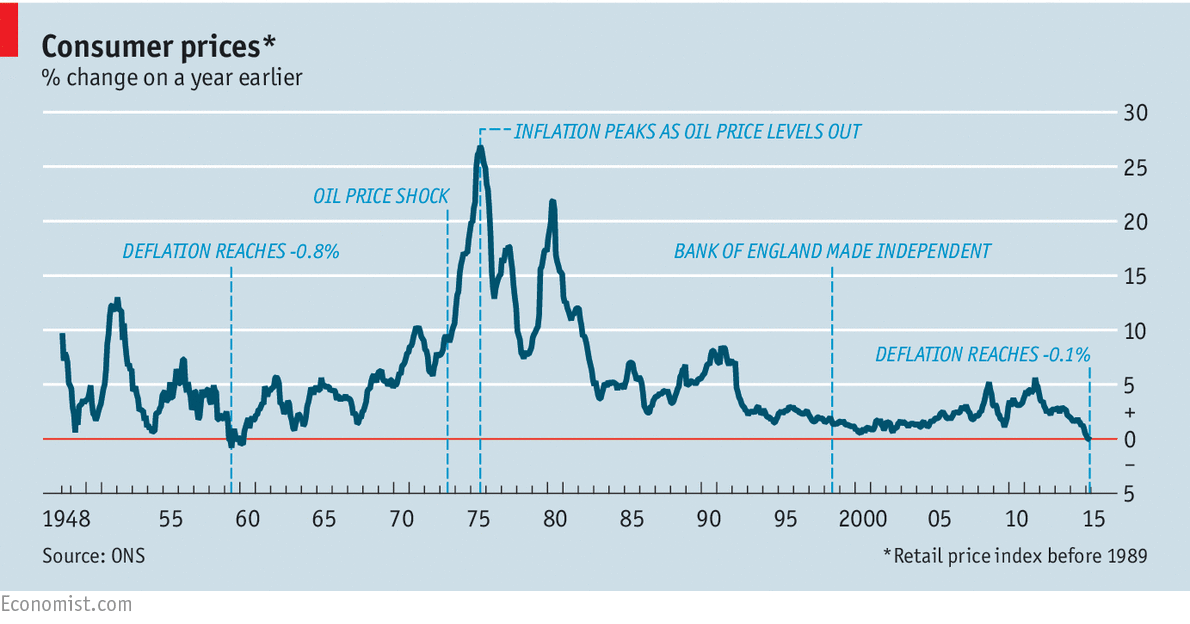

According to The Economist, in May 19th official statisticians announced that Britain entered deflation in April, with consumer prices standing 0.1% lower than a year earlier. It is first time since 1960 that annual inflation has been negative. Back then, prices pepped up again quickly. The Bank of England expects a similar rebound this time, on the basis that the recent fall in the price of food and fuel will be a one-off. But for inflation to return to the bank’s 2% target, sustained growth in wages is necessary. That means the bank is keeping a close eye on inflation expectations; if Britons start accepting lower pay rises on account of stagnant prices, deflation could persist.

According to The Economist, in May 19th official statisticians announced that Britain entered deflation in April, with consumer prices standing 0.1% lower than a year earlier. It is first time since 1960 that annual inflation has been negative. Back then, prices pepped up again quickly. The Bank of England expects a similar rebound this time, on the basis that the recent fall in the price of food and fuel will be a one-off. But for inflation to return to the bank’s 2% target, sustained growth in wages is necessary. That means the bank is keeping a close eye on inflation expectations; if Britons start accepting lower pay rises on account of stagnant prices, deflation could persist.

Here in the U.S. fears of deflation still linger with strength in the U.S. Dollar continuing to quash any strong moves in commodities. We've discussed it a few times before here and here. Tomorrow's GDP and PMI will be watched closely. At least it won't be a boring Friday morning.

Comments