Received this SoberLook email from member Ryan and had to chuckle. Did oil bulls (who are always drooling at the mouth) truly feel OPEC would cut production at some point to satisfy their desire for higher pricing? Come on. How much can the U.S.consumer handle with new jobs created at the low end of the scale? What would happen with $5 gas gasoline? Carpools would become all the rage here in my locale. At a time when the U.S. consumer needs money to spend, the impact of higher oil would be the last thing we need.

With low oil, the weak will fail and M&A will continue in the crowded space. Let new technology force cost savings (as we're seeing it every where else) and bring O&G production up to 21st century standards. I've written about it several times and I think the Saudis knew it was time.

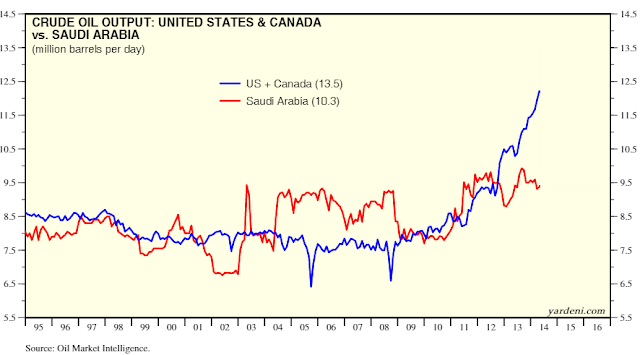

In 2014 the Saudis could no longer accept the loss of crude oil market share as the North American production levels shot up sharply over a three-year period.

|

| Source: Yardeni Researc |